Connect

Case Studies / Insurance Underwriting Dashboard

Case Studies / Insurance Underwriting Dashboard

Case Studies / Insurance Underwriting Dashboard

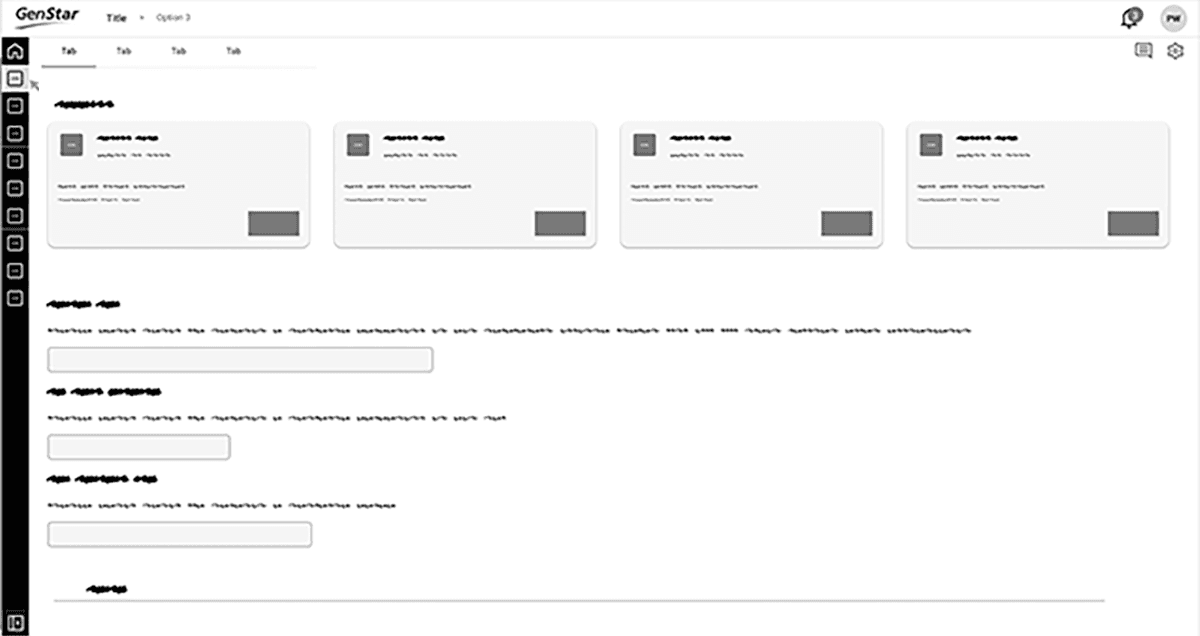

Unified Underwriting Experience

Unified Underwriting Experience

Unified Underwriting Experience

30% Faster Decisions With a Unified, Real‑Time Workflow

30% Faster Decisions With a Unified, Real‑Time Workflow

Read time: 6–7 minutes

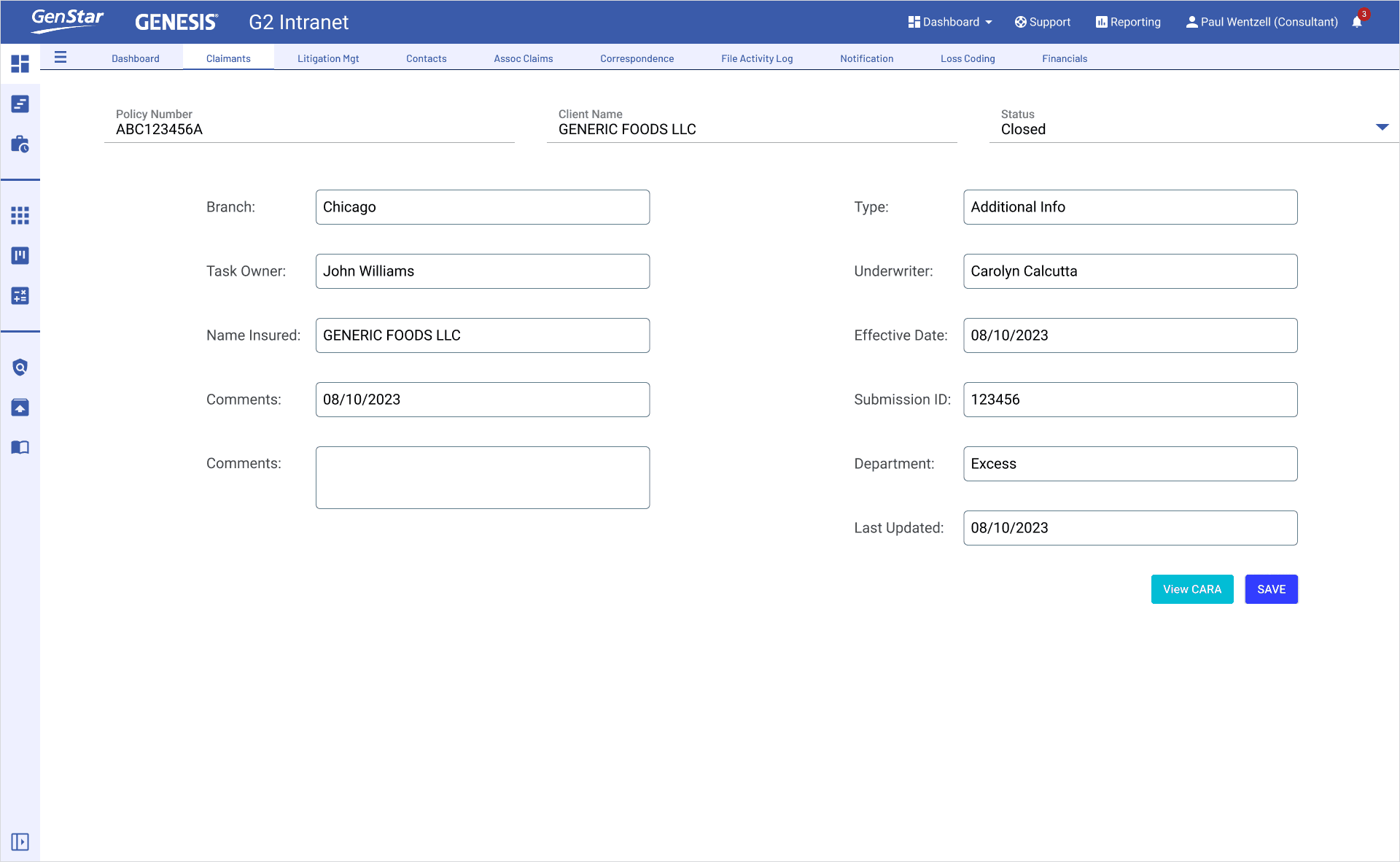

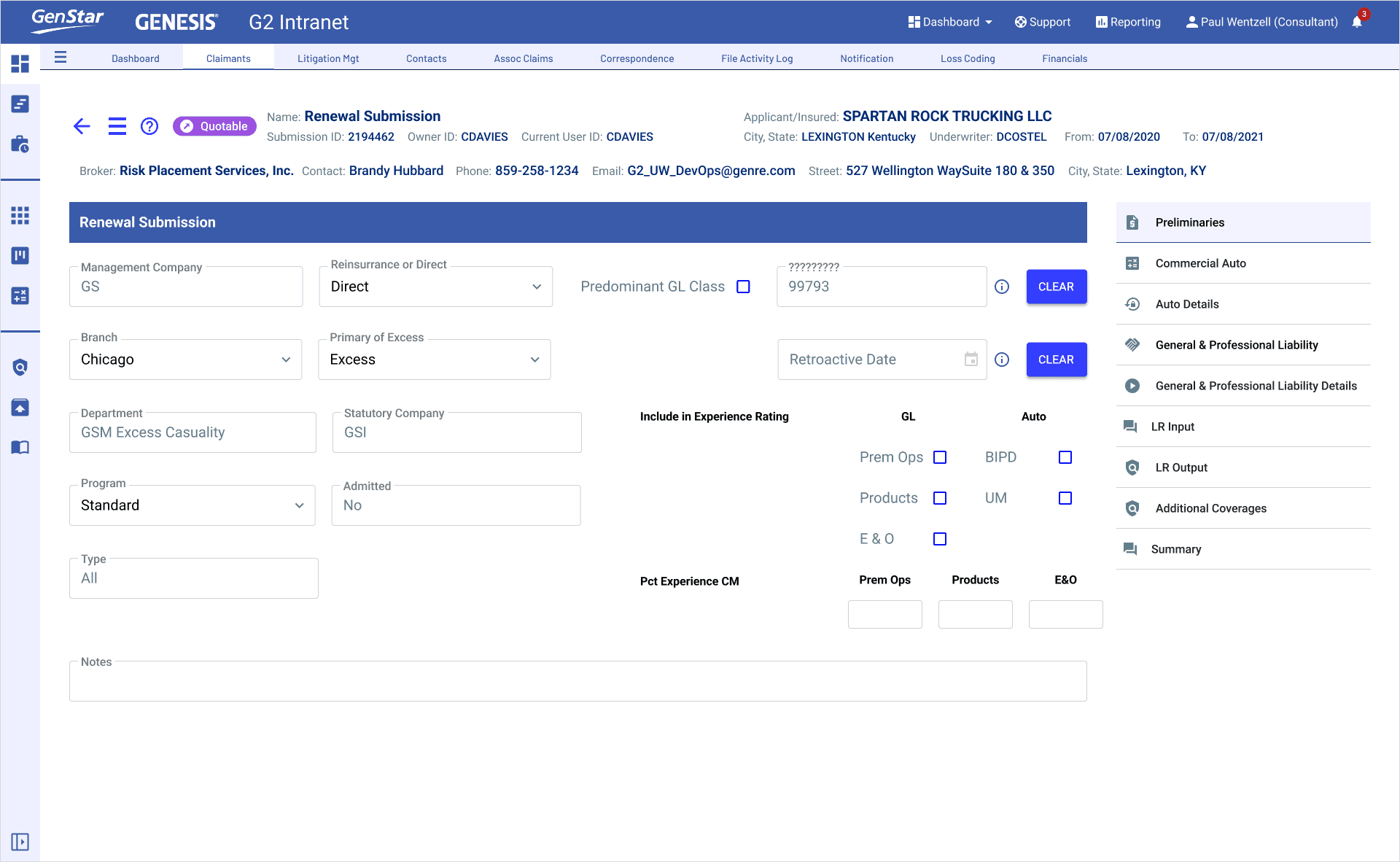

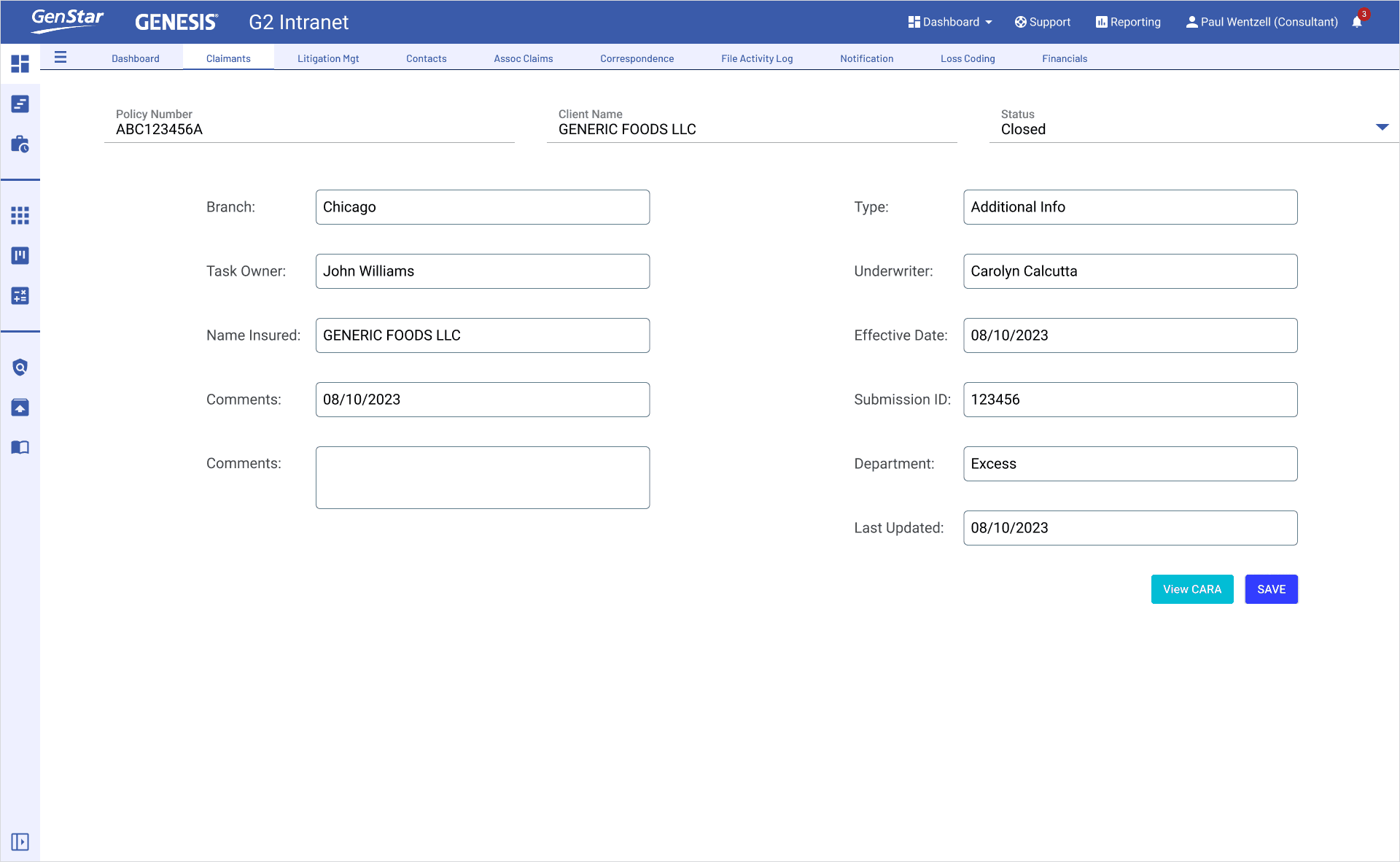

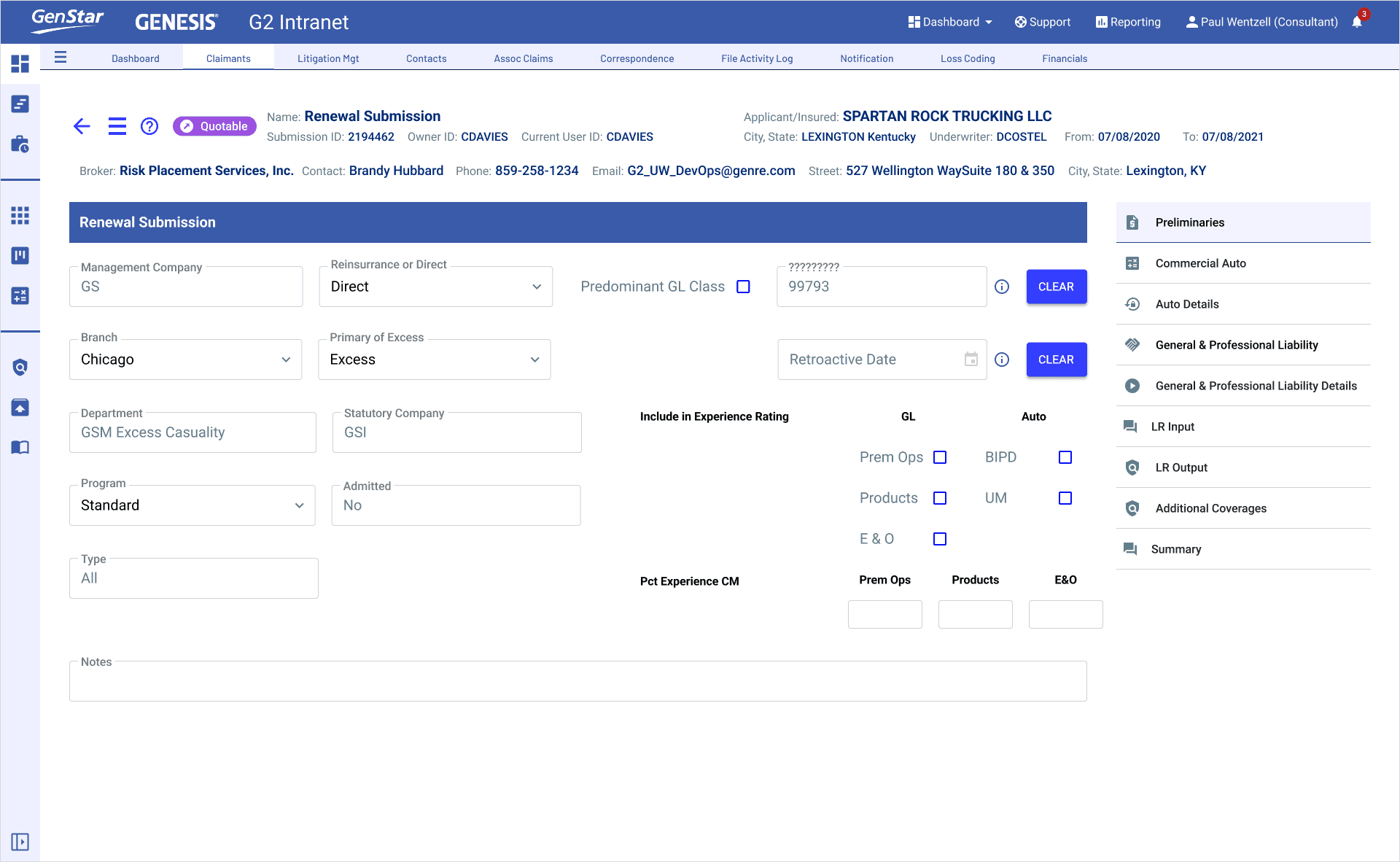

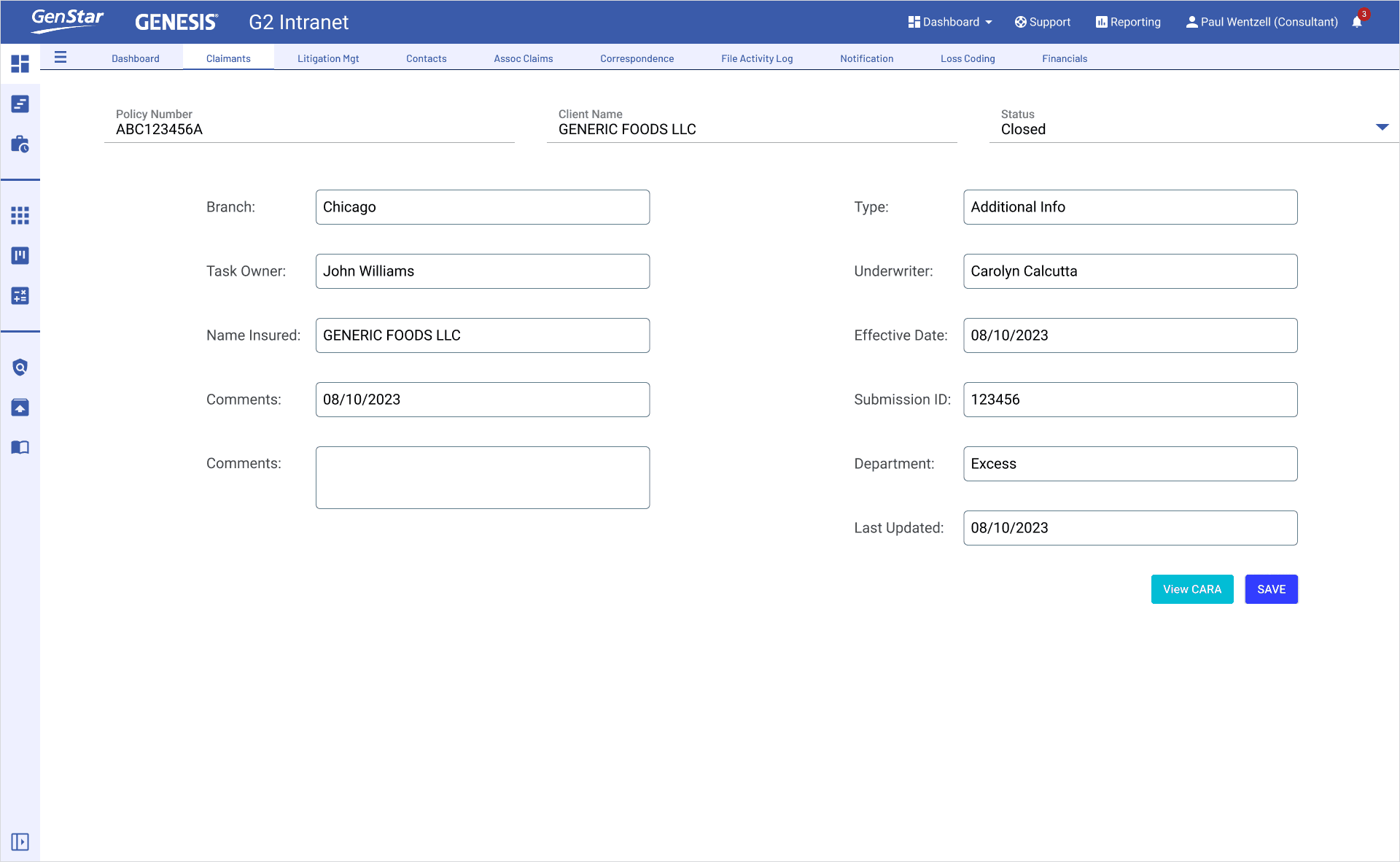

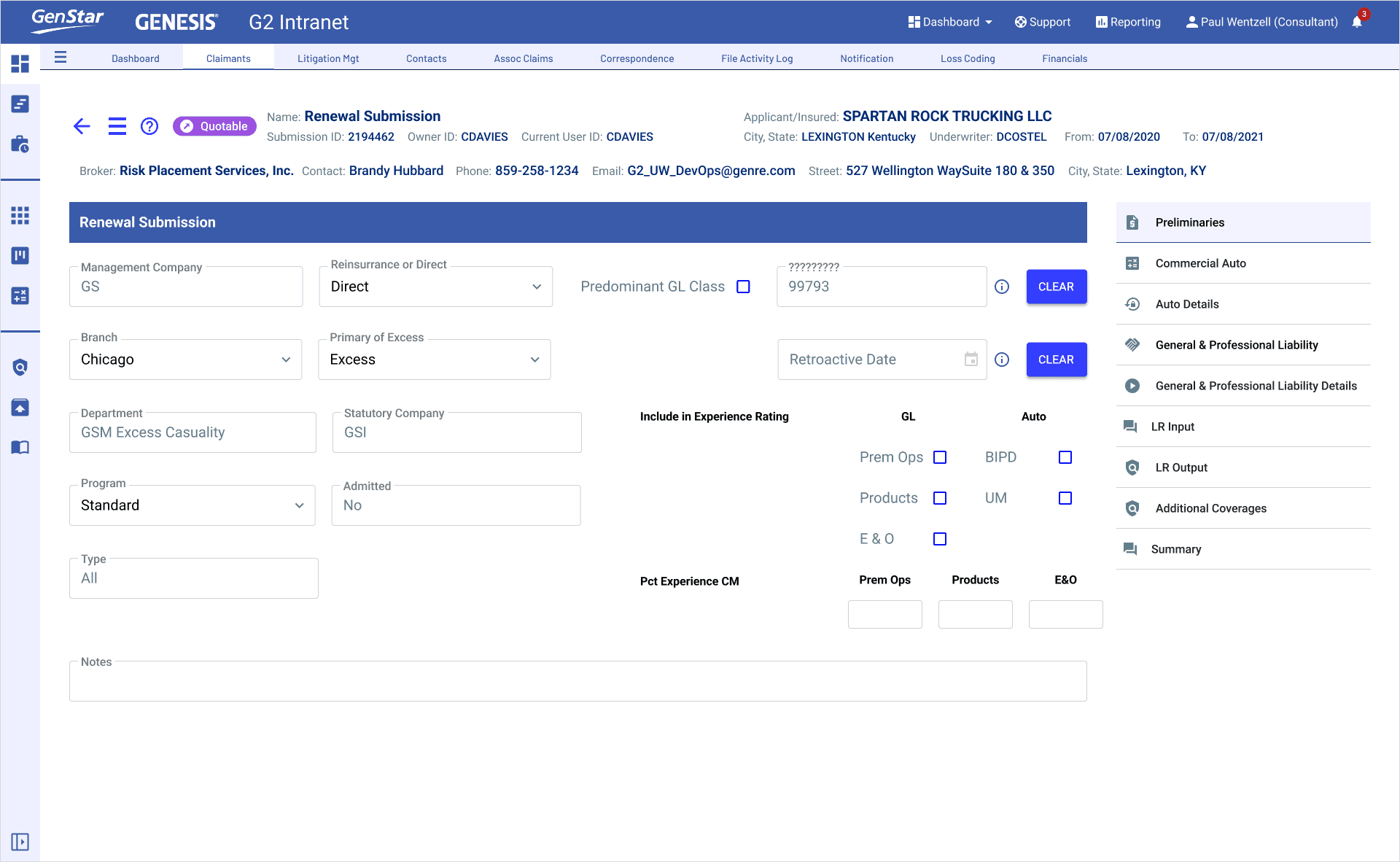

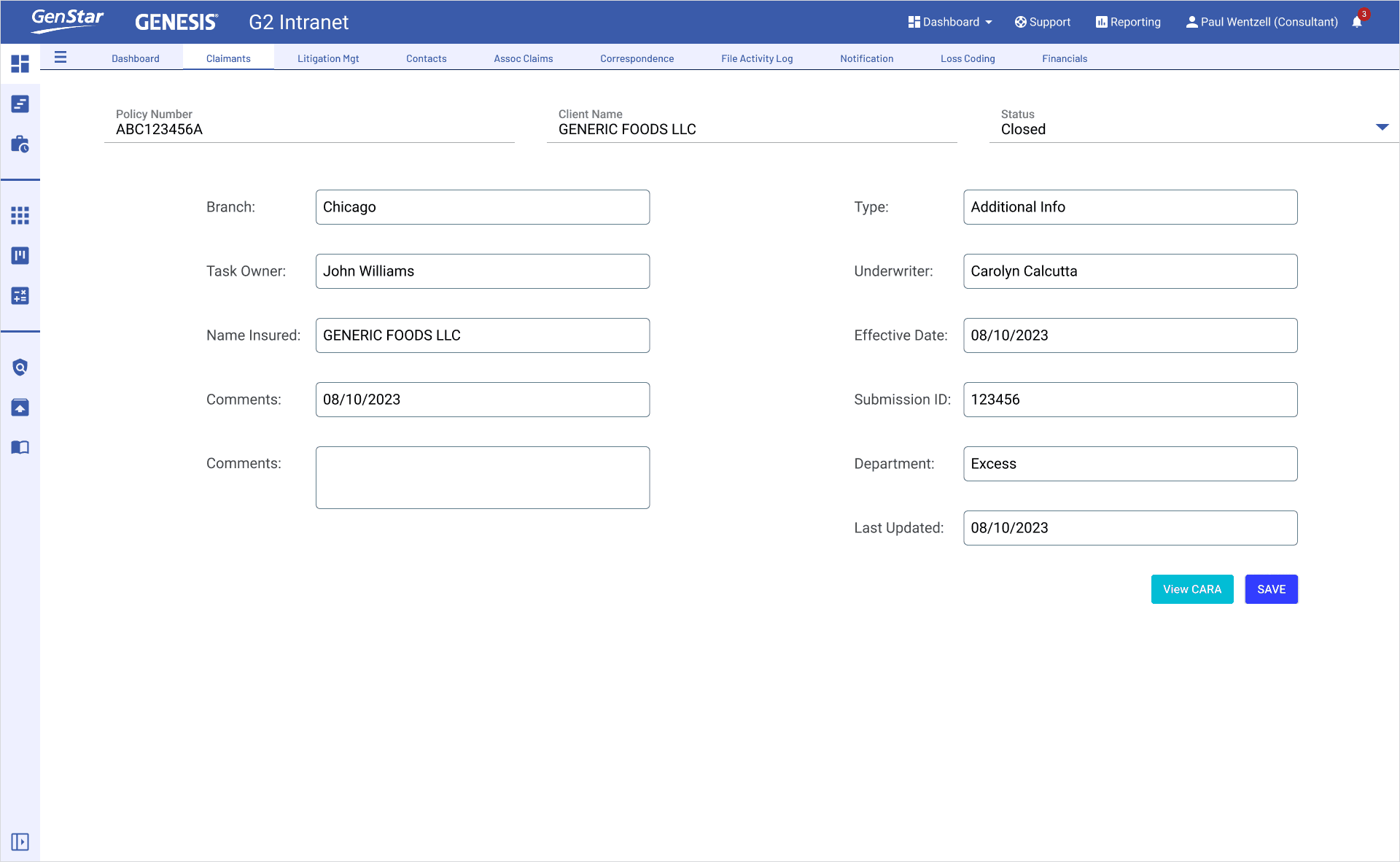

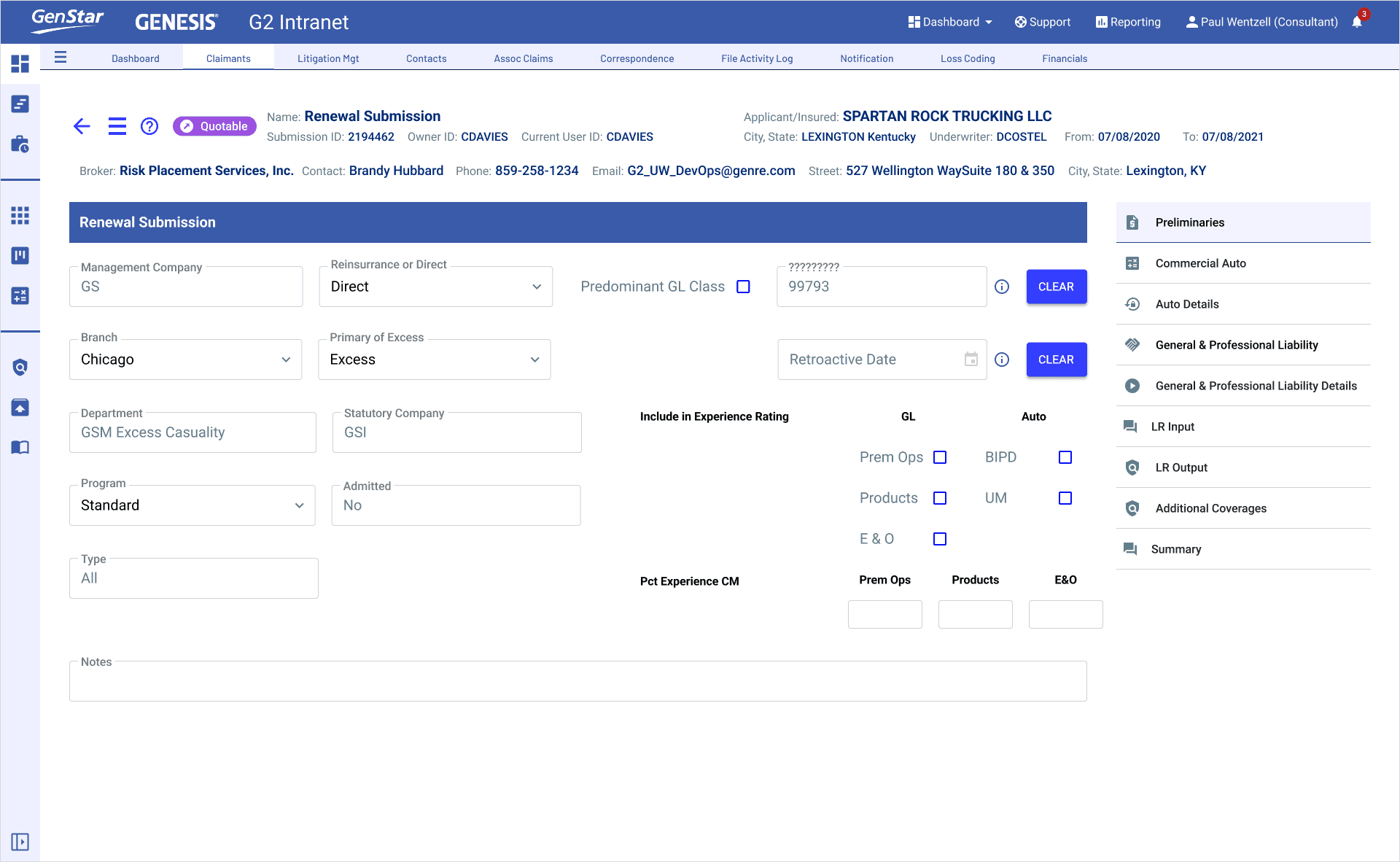

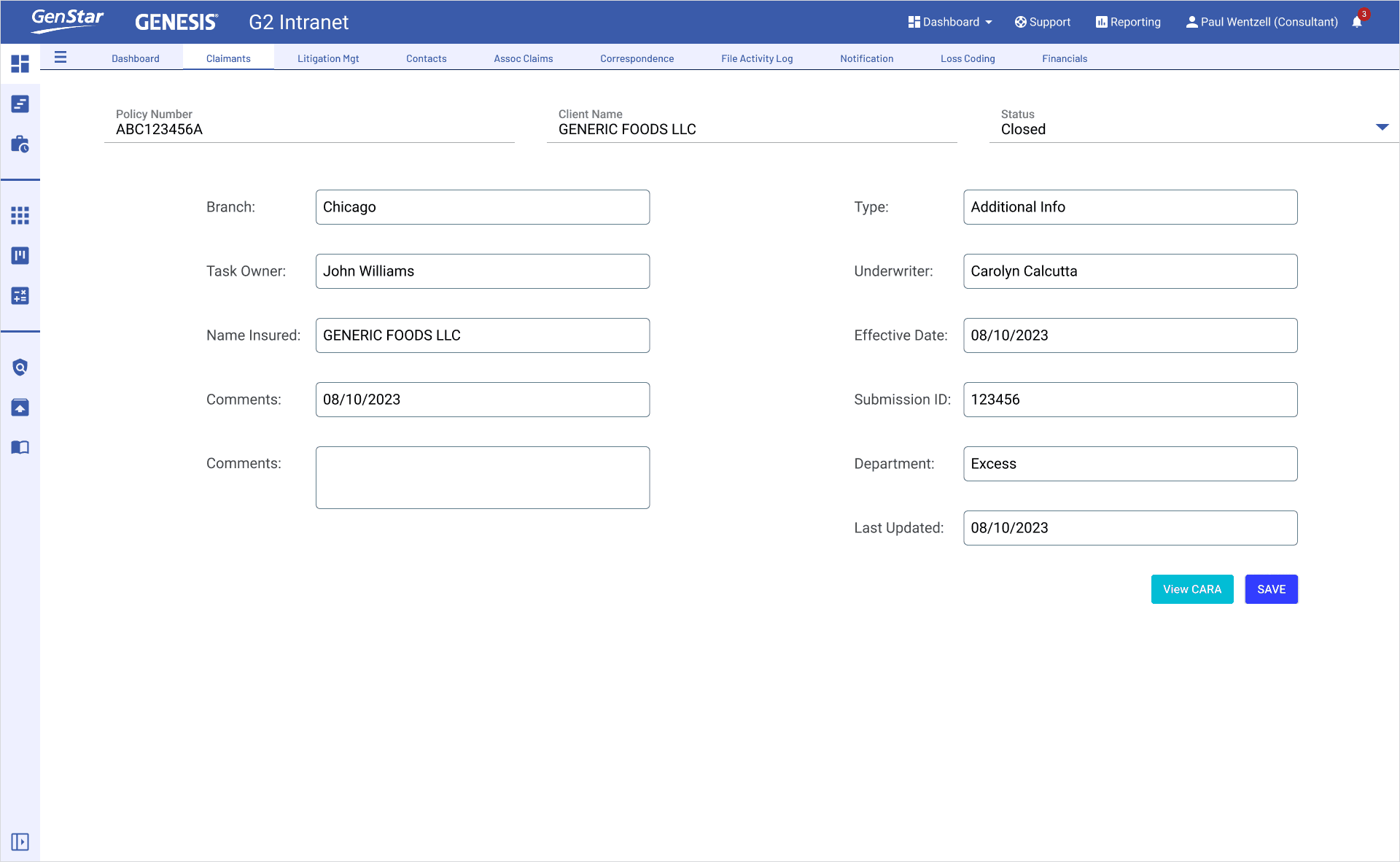

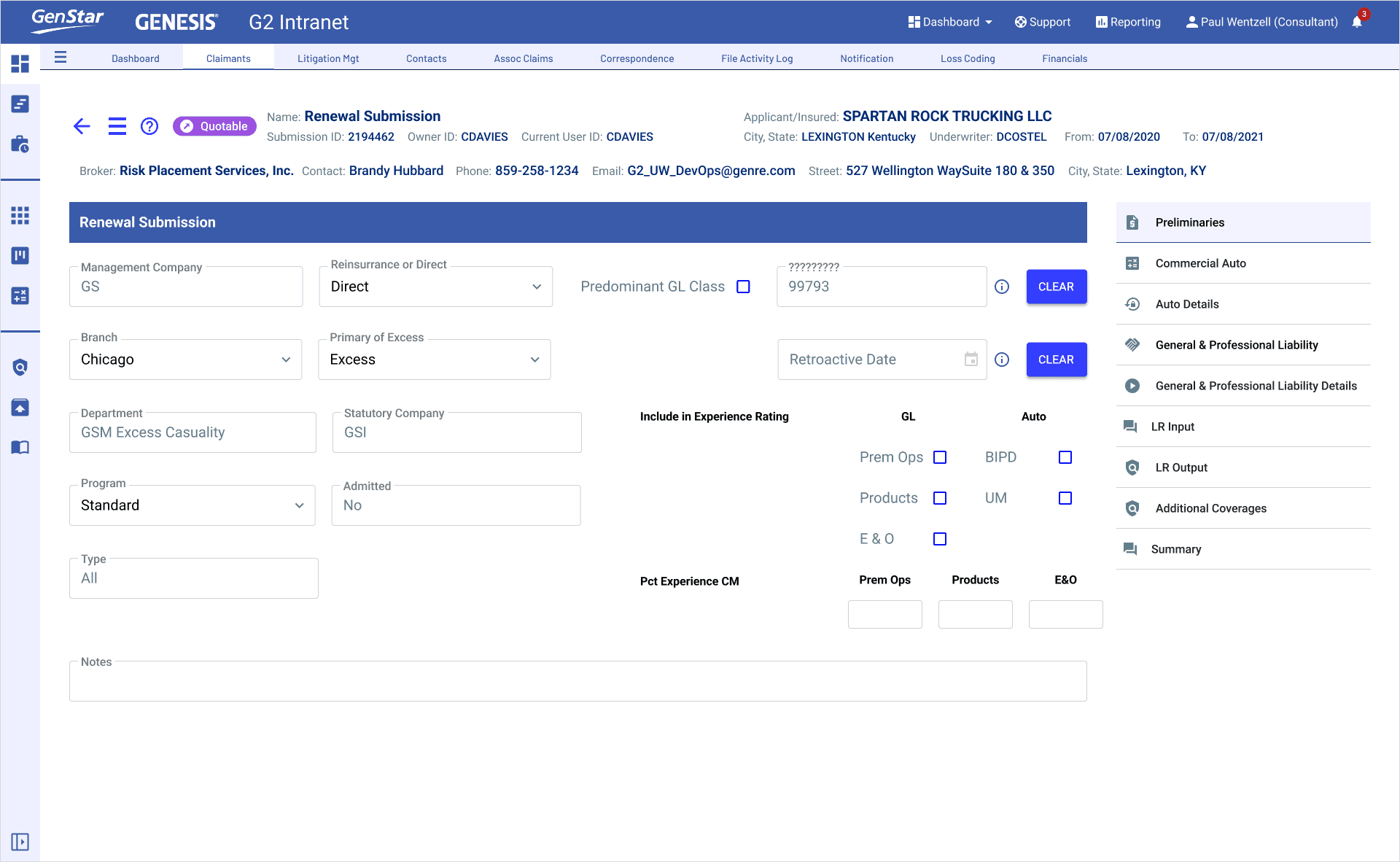

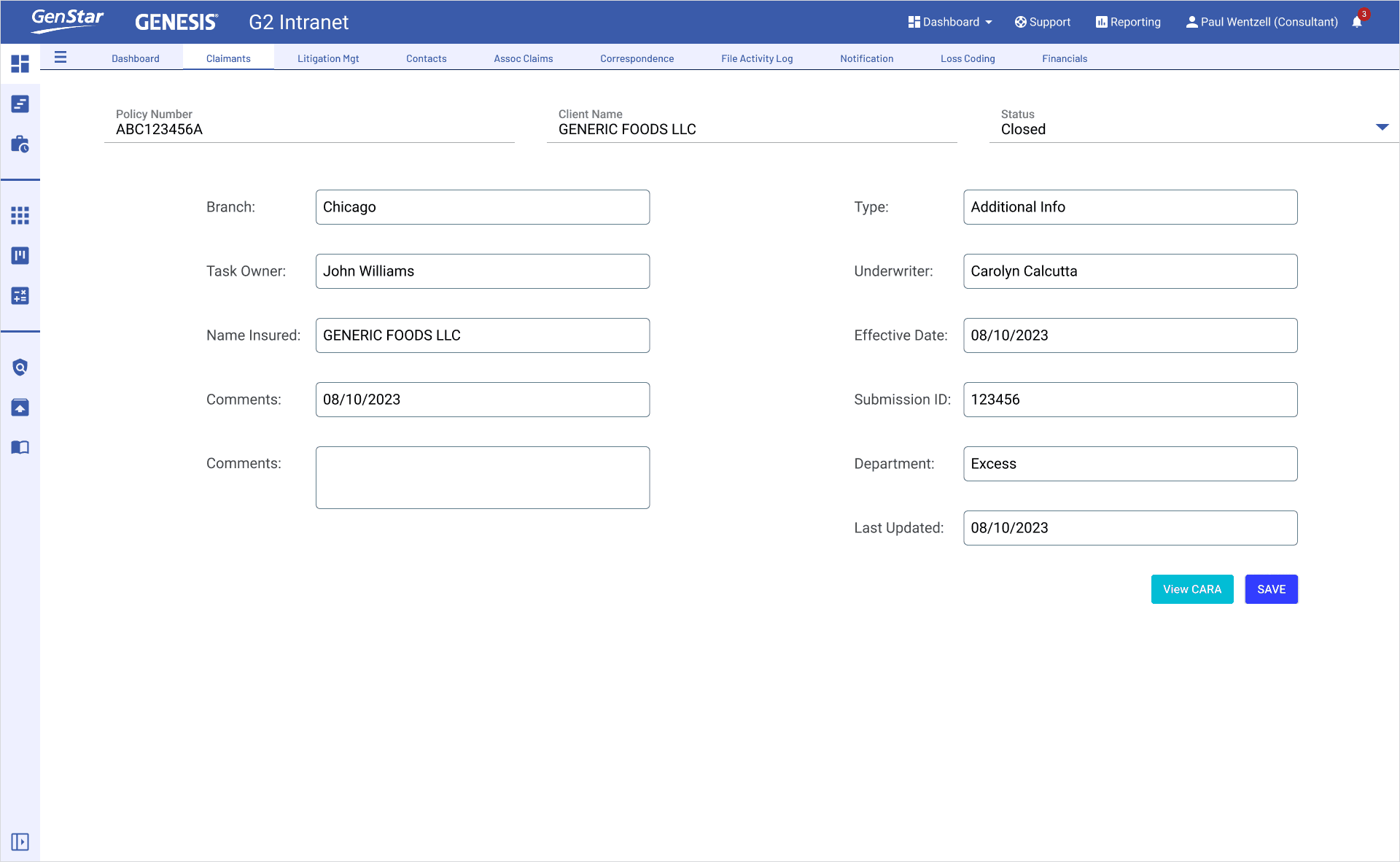

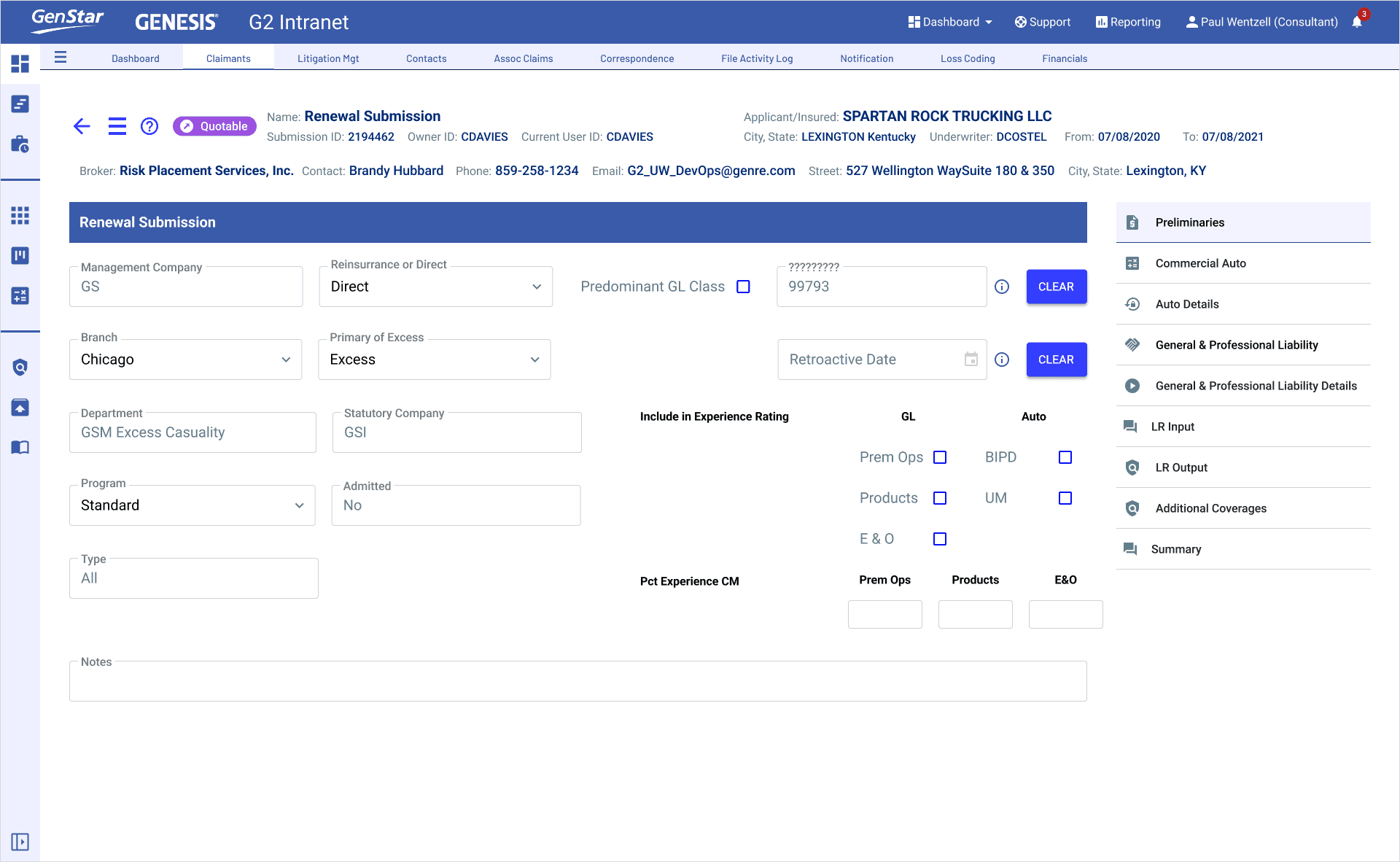

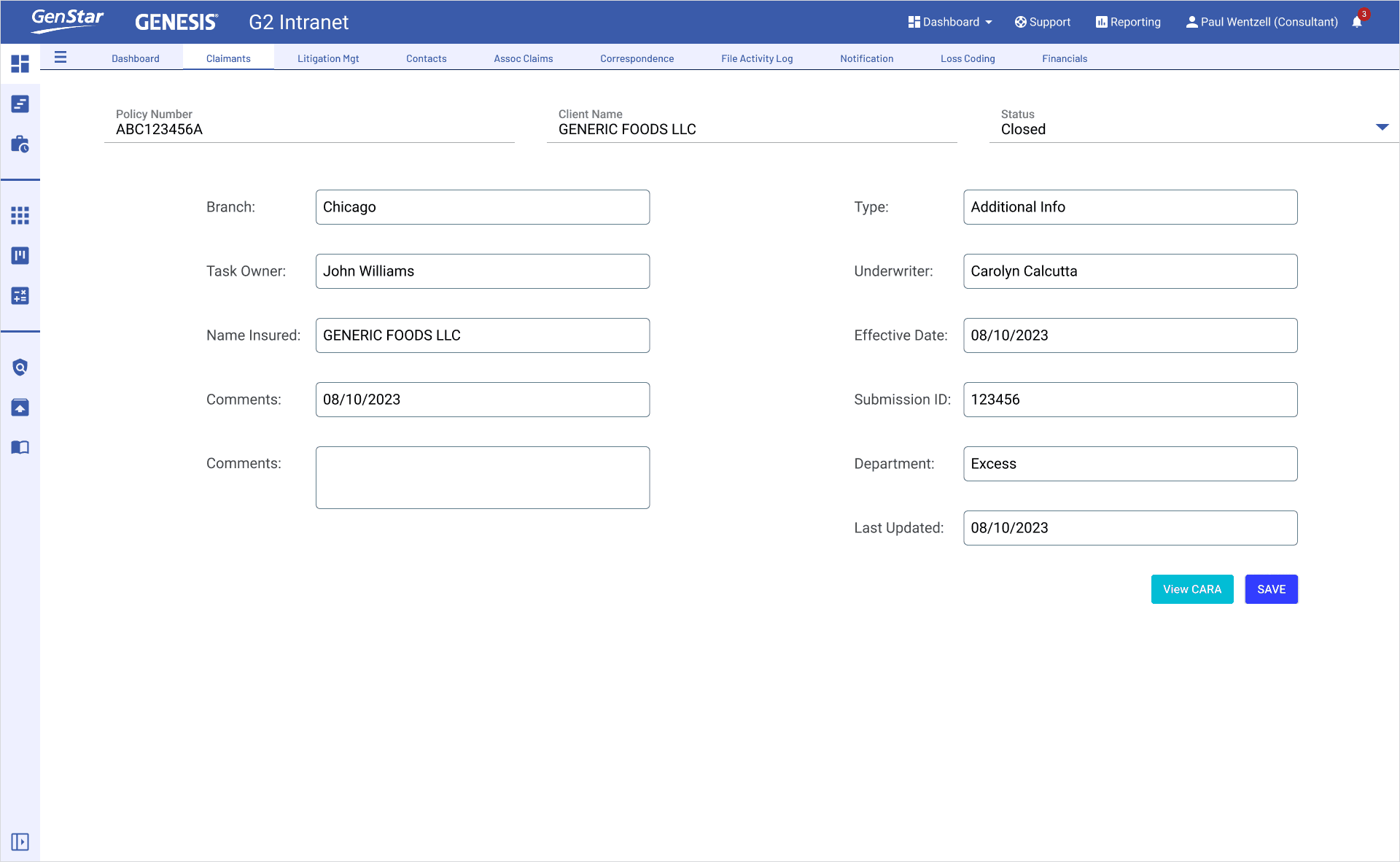

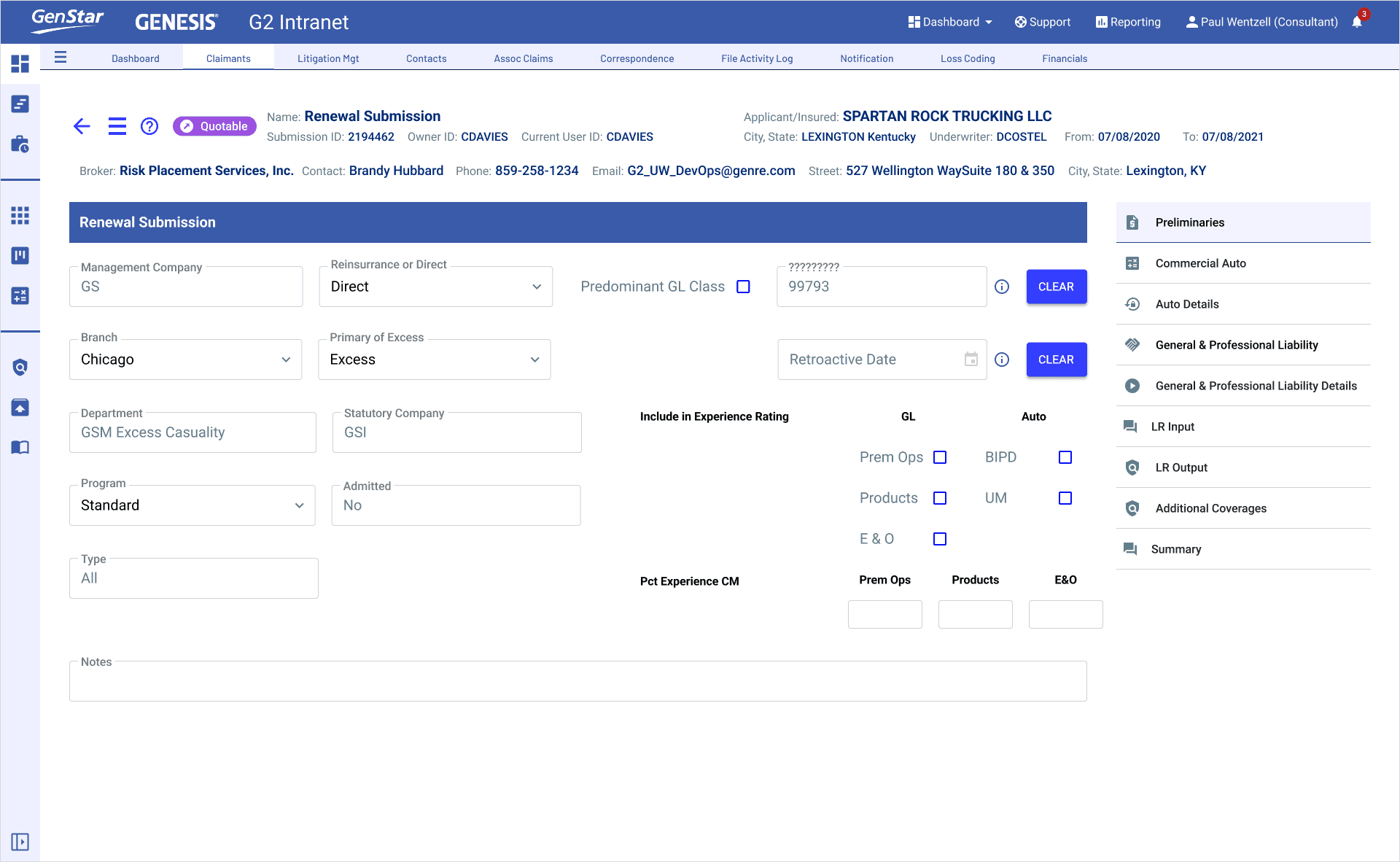

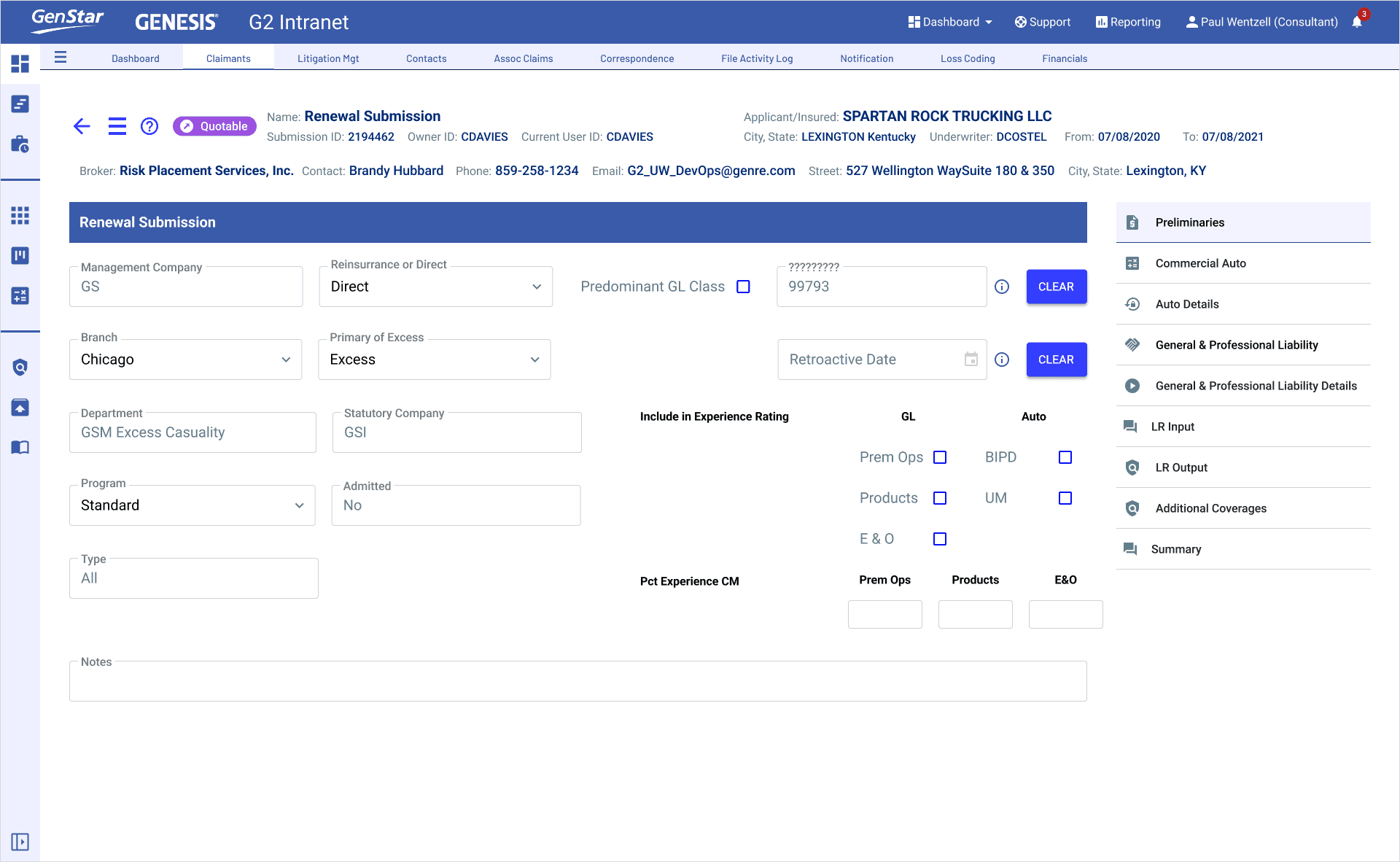

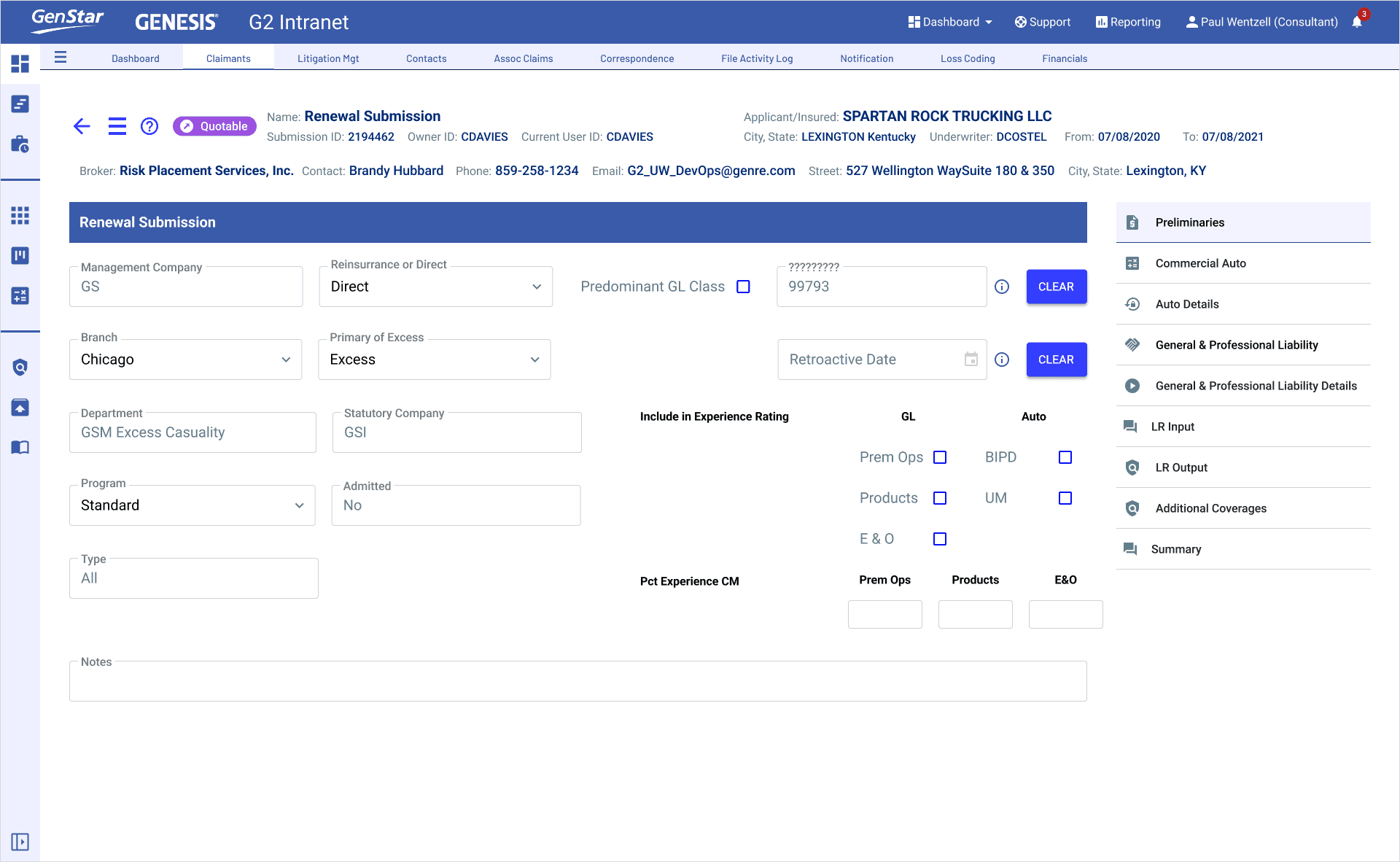

General Star’s underwriting teams were slowed by scattered tools, inconsistent layouts, and manual lookups that broke focus. I led the design of their first unified underwriting dashboard for the GENESIS G2 intranet streamlining workflows, embedding reusable Material components, and establishing a governed system that scaled across teams and frameworks.

GenStar Insurance’s underwriting teams were slowed by fragmented tools, inconsistent UI patterns, and manual processes that created friction at every step.

As Principal UX/UI Designer, I designed the first unified underwriting dashboard for the GENESIS G2 intranet streamlining workflows, embedding reusable Google Material components, and establishing governance that scaled across teams and frameworks.

GenStar Insurance’s underwriting teams were slowed by fragmented tools, inconsistent UI patterns, and manual processes that created friction at every step.

As Principal UX/UI Designer, I designed the first unified underwriting dashboard for the GENESIS G2 intranet streamlining workflows, embedding reusable Google Material components, and establishing governance that scaled across teams and frameworks.

Client / General Star

Client / General Star

Role / General Star Insurance

Category / Insurance

Category / Insurance

Tools / Figma, Jira, Confluence

Team / UX, Product, Engineering

Team / UX, Product, Engineering

Team / UX, Product, Engineering

Platform / React with custom Google Material design system

Platform / React with custom Blazor design system

Platform / React with custom Blazor design system

Outcome Summary

User Experience Improvements

User Experience Improvements

User Experience Improvements

• Faster decisions with clearer, more focused workflows

• Real‑time signals surfaced without leaving the screen

• Less cognitive load from fewer lookups and cleaner hierarchy

Faster decisions with cleaner, more focused workflows

Real-time signals surfaced without leaving the screen

Less cognitive load from fewer lookups and cleaner hierarchy

Engineering Alignment

Engineering Alignment

Engineering Alignment

• LED parity

• Bluetooth behavior

• Real‑time data modeling

• Cross‑platform consistency (.NET MAUI)

• Shared component names and standards kept design and dev in sync

• Implementation‑ready specs reduced back‑and‑forth and rework

• Scalable patterns made new screens easier to build and maintain

Business Value

Business Value

Business Value

More consistent decisions through unified tools and patterns

Lower long‑term overhead with a modular, governed system

A clearer foundation for future real‑time features and expansion

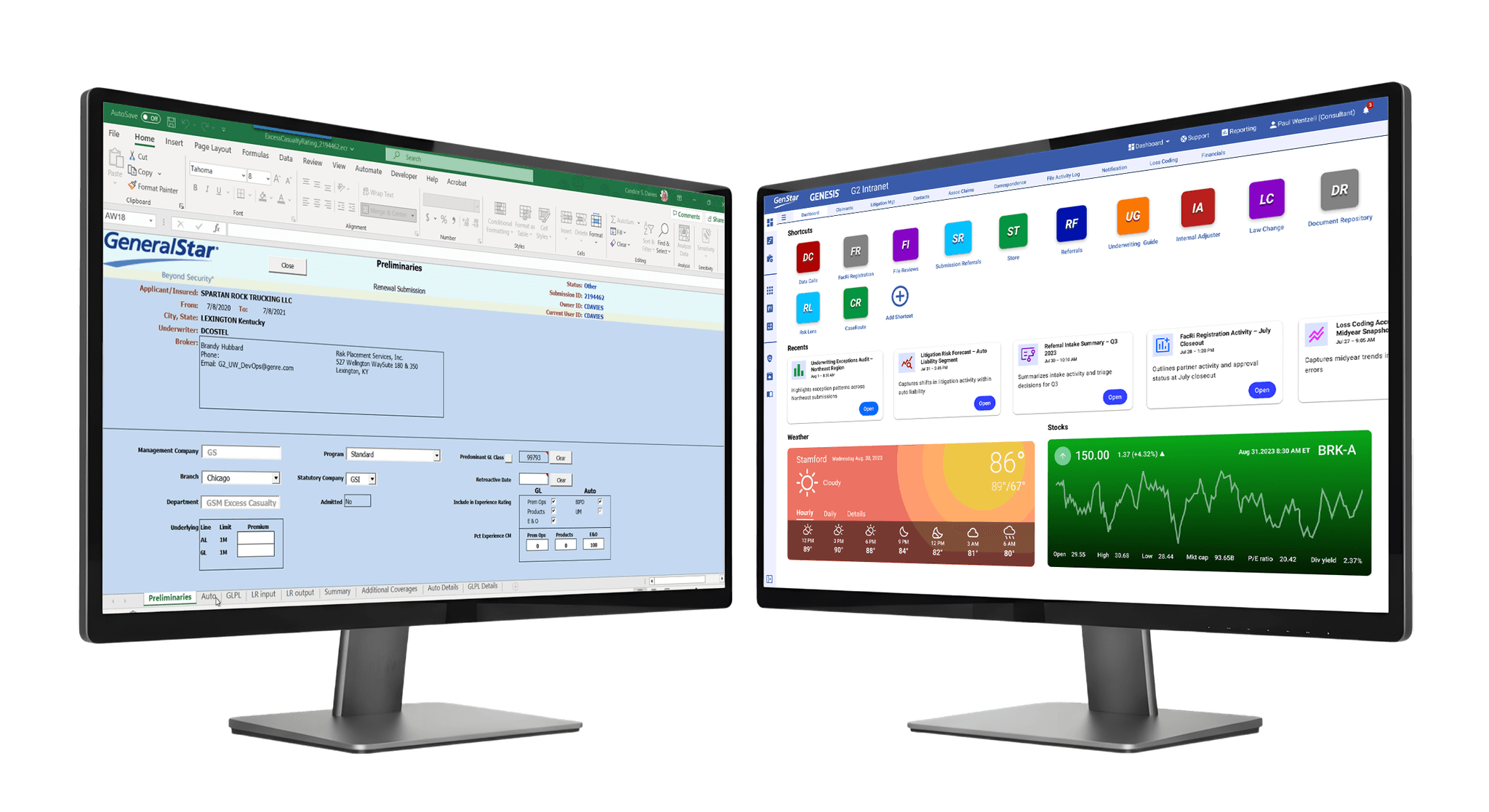

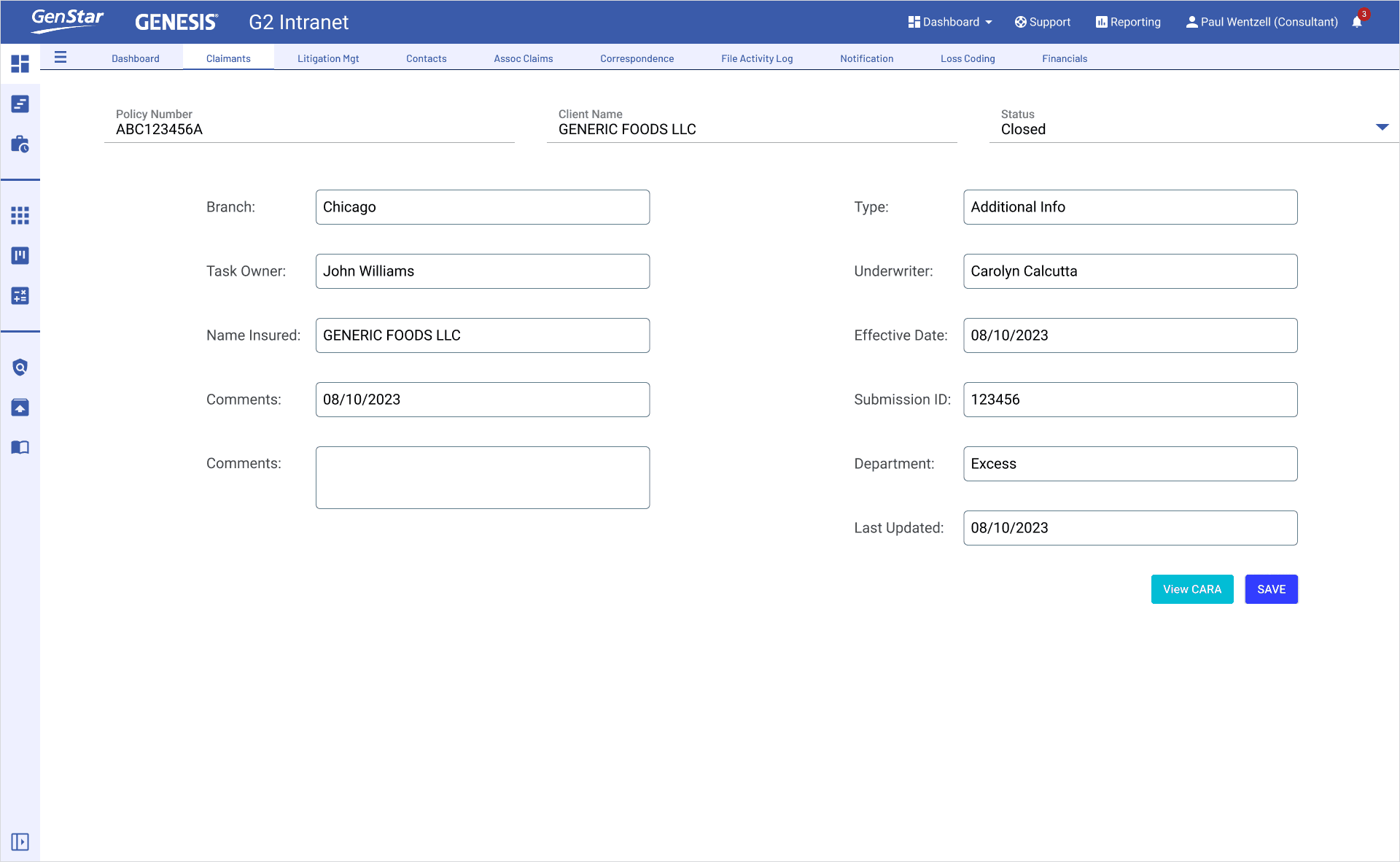

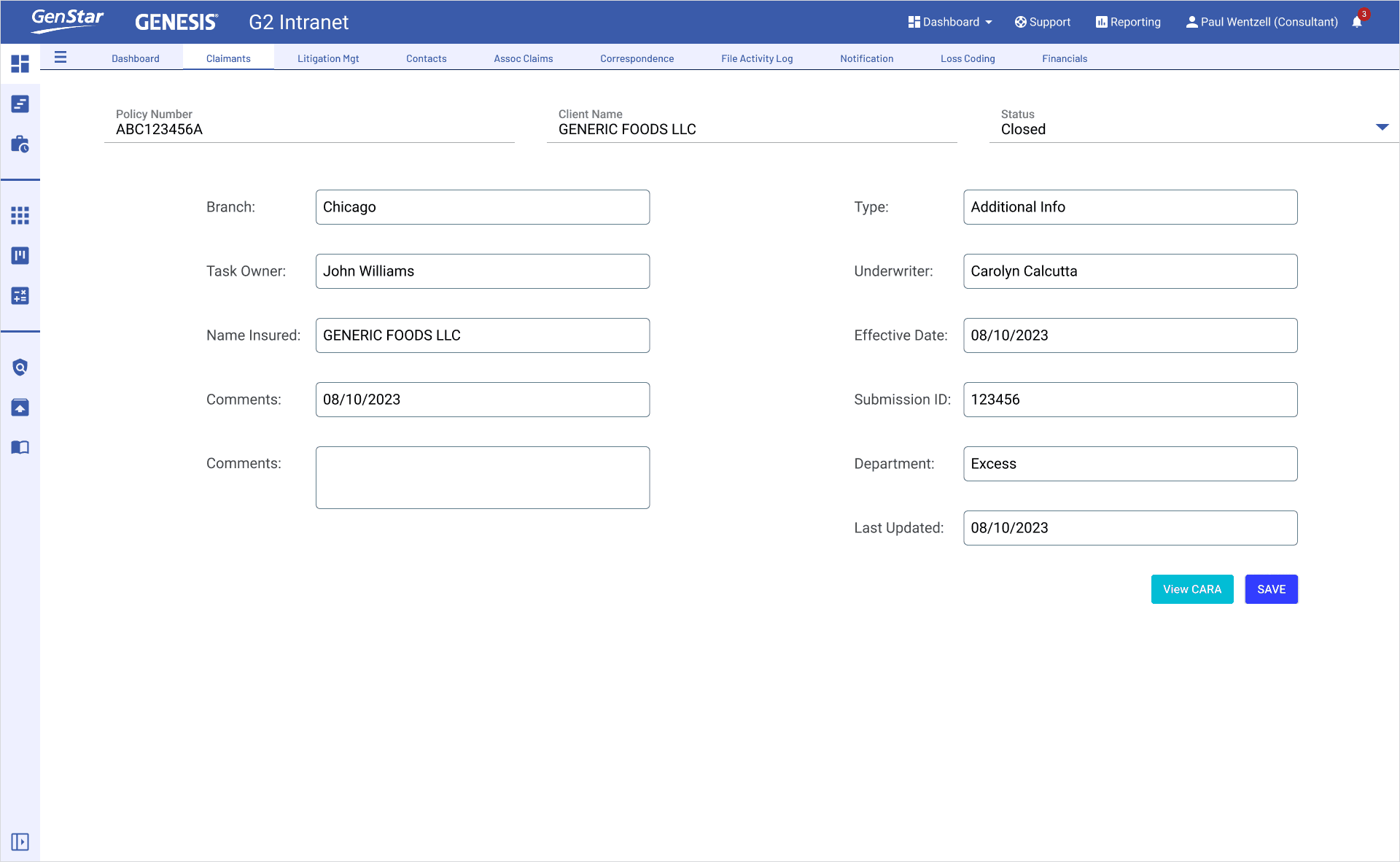

Before → What wasn't working

Understanding the problem

Underwriters were working across outdated tools, Excel sheets, and disconnected screens. Key signals weather, market shifts were buried or missing entirely. The result was slow decisions, inconsistent reviews, and high cognitive load.

Underwriters were working across outdated tools, Excel sheets, and disconnected screens. Key signals weather, market shifts were buried or missing entirely. The result was slow decisions, inconsistent reviews, and high cognitive load.

What was found

Data scattered across slow, legacy tools

No single dashboard to anchor the underwriting workflow

Layouts and patterns inconsistent across React, Angular, and AG Grid

Manual lookups for weather, market activity, and exposure context

Why it mattered

Slower intake and review decisions

Higher chance of missing critical details

Operational risk from inconsistent workflow

Impact (After)

A shared baseline for redesign priorities: real‑time context, unified hierarchy, and predictable patterns across the underwriting workflow.

Before → Discovery Insights

We ran stakeholder interviews, workflow reviews, and a comparative audit across Adobe, Payfactors, Zoho, and internal tools. Adobe became the primary benchmark for clarity and density.

We ran stakeholder interviews, workflow reviews, and a comparative audit across Adobe, Payfactors, Zoho, and internal tools. Adobe became the primary benchmark for clarity and density.

What underwriters an stakeholders told us

What underwriters an stakeholders told us

“Seasonal patterns matter, freeze warnings, heat waves, hurricane season. I need that context at the moment I’m evaluating the account.”

“Seasonal patterns matter, freeze warnings, heat waves, hurricane season. I need that context at the moment I’m evaluating the account.”

“Seasonal patterns matter, freeze warnings, heat waves, hurricane season. I need that context at the moment I’m evaluating the account.”

“If a company’s stock drops 10% in a day, that’s a signal something’s going on financially. I need to factor that in.”

“If a company’s stock drops 10% in a day, that’s a signal something’s going on financially. I need to factor that in.”

“If a company’s stock drops 10% in a day, that’s a signal something’s going on financially. I need to factor that in.”

“The systems are so old and clunky that by the time you find what you need, you’ve already lost your train of thought.”

“The systems are so old and clunky that by the time you find what you need, you’ve already lost your train of thought.”

“The systems are so old and clunky that by the time you find what you need, you’ve already lost your train of thought.”

“The systems are so old and clunky that by the time you find what you need, you’ve already lost your train of thought.”

“The systems are so old and clunky that by the time you find what you need, you’ve already lost your train of thought.”

“The systems are so old and clunky that by the time you find what you need, you’ve already lost your train of thought.”

“We’re leaving money on the table because critical context is buried. By the time someone pieces everything together, the opportunity has already moved on.”

“We’re leaving money on the table because critical context is buried. By the time someone pieces everything together, the opportunity has already moved on.”

“We’re leaving money on the table because critical context is buried. By the time someone pieces everything together, the opportunity has already moved on.”

Comparative Audit discovery

What This Clarified

• The dashboard needed real‑time context, not static summaries

• Dense data required clean hierarchy and predictable patterns

• Navigation needed to be anchored, consistent, and scalable

• Engineering needed shared components and naming to reduce rework

What this clarified

The dashboard needed real‑time context, not static summaries

Dense data required clean hierarchy and predictable patterns

Navigation needed to be anchored, consistent, and scalable

Engineering needed shared components and naming to reduce rework

Design Strategy→ The goal was simple: create a unified, governed workspace that reduced friction, improved clarity, and gave underwriters the signals they needed without leaving the screen.

Design Strategy→ The goal was simple: create a unified, governed workspace that reduced friction, improved clarity, and gave underwriters the signals they needed without leaving the screen.

During → Branding & Font System Decisions

The Underwriting Dashboard needed a consistent visual system, but no brand guidelines or design documentation existed. I pulled colors, typography, and layout patterns directly from the public website to establish a provisional base. Barlow was retained for general UI continuity, and Roboto was introduced for AG Grid to provide the monospaced clarity needed for dense, tabular data.

The Underwriting Dashboard needed a consistent visual system, but no brand guidelines or design documentation existed. I pulled colors, typography, and layout patterns directly from the public website to establish a provisional base.

Barlow was retained for general UI continuity, and Roboto was introduced for AG Grid to provide the monospaced clarity needed for dense, tabular data.

What was delivered

• Extracted font sizes, weights, and color codes from the public site

• Built a provisional design system for dashboard use

• Retained Barlow for general UI consistency

• Introduced Roboto for AG Grid and tabular components

• Documented font usage by component type and interaction pattern

What was delivered

Enabled consistent visual language across the dashboard despite lack of brand support

Improved data legibility and alignment in grid-based components

Created a scalable foundation for future design system formalization

Impact (After)

Enabled consistent visual language across the dashboard despite lack of brand support

Improved data legibility and alignment in grid-based components

Created a scalable foundation for future design system formalization

Impact (After)

Enabled consistent visual language across the dashboard despite lack of brand support

Improved data legibility and alignment in grid-based components

Created a scalable foundation for future design system formalization

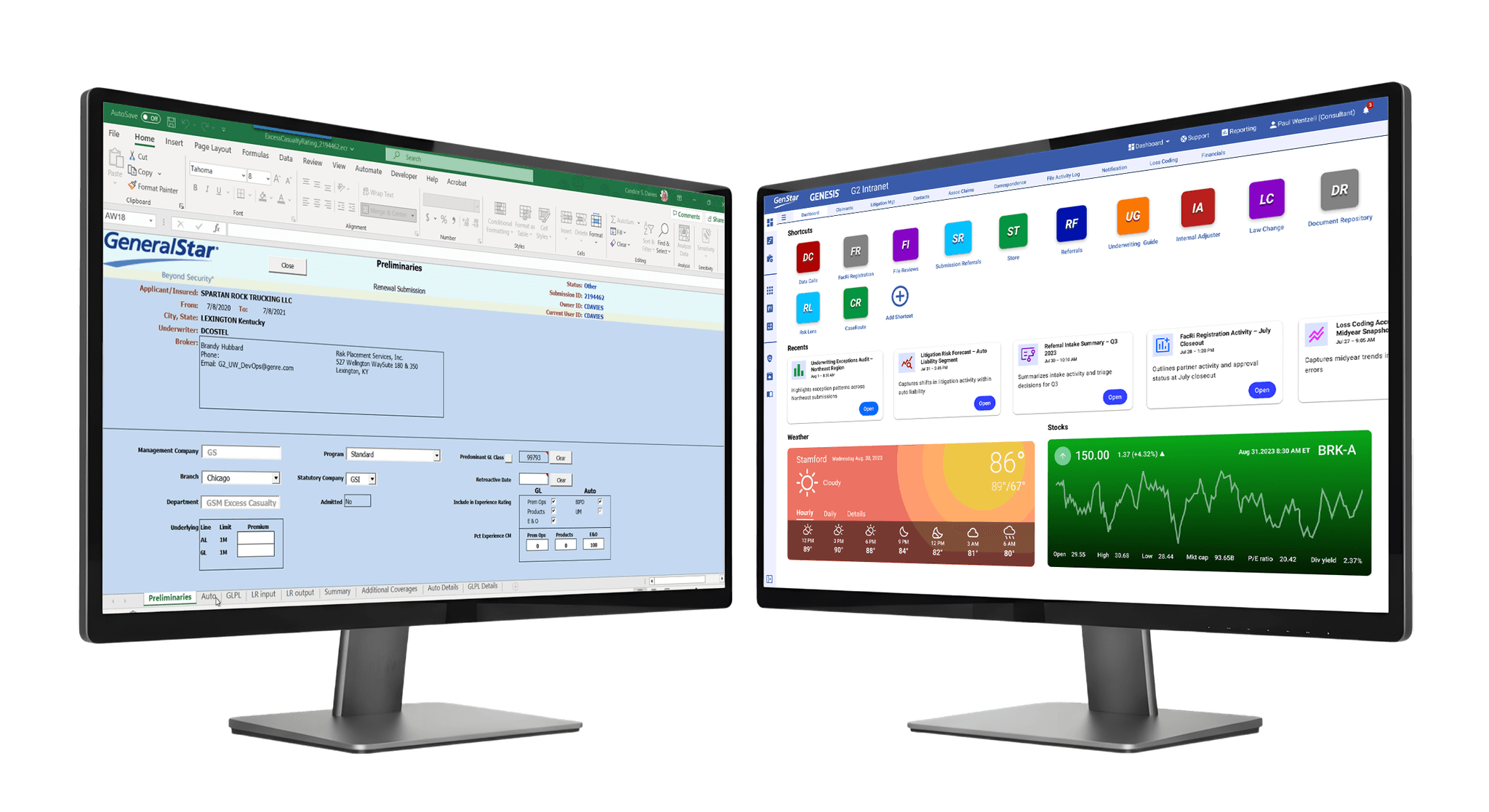

During → Material Aligned Theme & Component System

To eliminate styling drift across React, Angular, and AG Grid, I built a custom Material theme with tokenized color, spacing, and typography. This included a full set of reusable components buttons, inputs, selects, tabs, and table patterns all built in Figma with developer‑ready specs.

To eliminate styling drift across React, Angular, and AG Grid, I built a custom Material theme with tokenized color, spacing, and typography. This included a full set of reusable components buttons, inputs, selects, tabs, and table patterns all built in Figma with developer‑ready specs.

What was delivered

• Custom Material components (buttons, inputs, selects, tabs, alerts, chips)

• Figma components aligned to Material and AG Grid behavior

• Token‑based system for color, spacing, and type

• Unified styling across React, Angular, and AG Grid

• Clear rules, edge cases, and reuse logic

What was found

Styling gaps created friction for both underwriters and engineering

AG Grid default styling caused visual drift and layout inconsistencies

Impact

• Cleaner, more predictable UI across the entire workspace

• Faster engineering delivery with fewer questions and less rework

• A scalable foundation for future features

Why was designed

Figma components aligned to Material patterns

Token-based system for color, spacing, and typography

Unified styling across Material UI and AG Grid

Impact (After)

Faster engineering delivery with fewer questions and less rework

Cleaner, more predictable UI across the entire workspace

A scalable foundation for future features

Why it mattered

Inconsistent components slowed task flow and increased cognitive load

Engineering teams faced repeated rework to maintain parity across frameworks

Impact (After)

Faster engineering delivery with fewer questions and less rework

Cleaner, more predictable UI across the entire workspace

A scalable foundation for future features

During → Clarifying Dense Underwriting Data

The Underwriting Dashboard needed a consistent visual system, but no brand guidelines or design documentation existed. I pulled colors, typography, and layout patterns directly from the public website to establish a provisional base.

Barlow was retained for general UI continuity, and Roboto was introduced for AG Grid to provide the monospaced clarity needed for dense, tabular data.

What was delivered

Enabled consistent visual language across the dashboard despite lack of brand support

Improved data legibility and alignment in grid-based components

Created a scalable foundation for future design system formalization

Impact (After)

Enabled consistent visual language across the dashboard despite lack of brand support

Improved data legibility and alignment in grid-based components

Created a scalable foundation for future design system formalization

Impact (After)

Enabled consistent visual language across the dashboard despite lack of brand support

Improved data legibility and alignment in grid-based components

Created a scalable foundation for future design system formalization

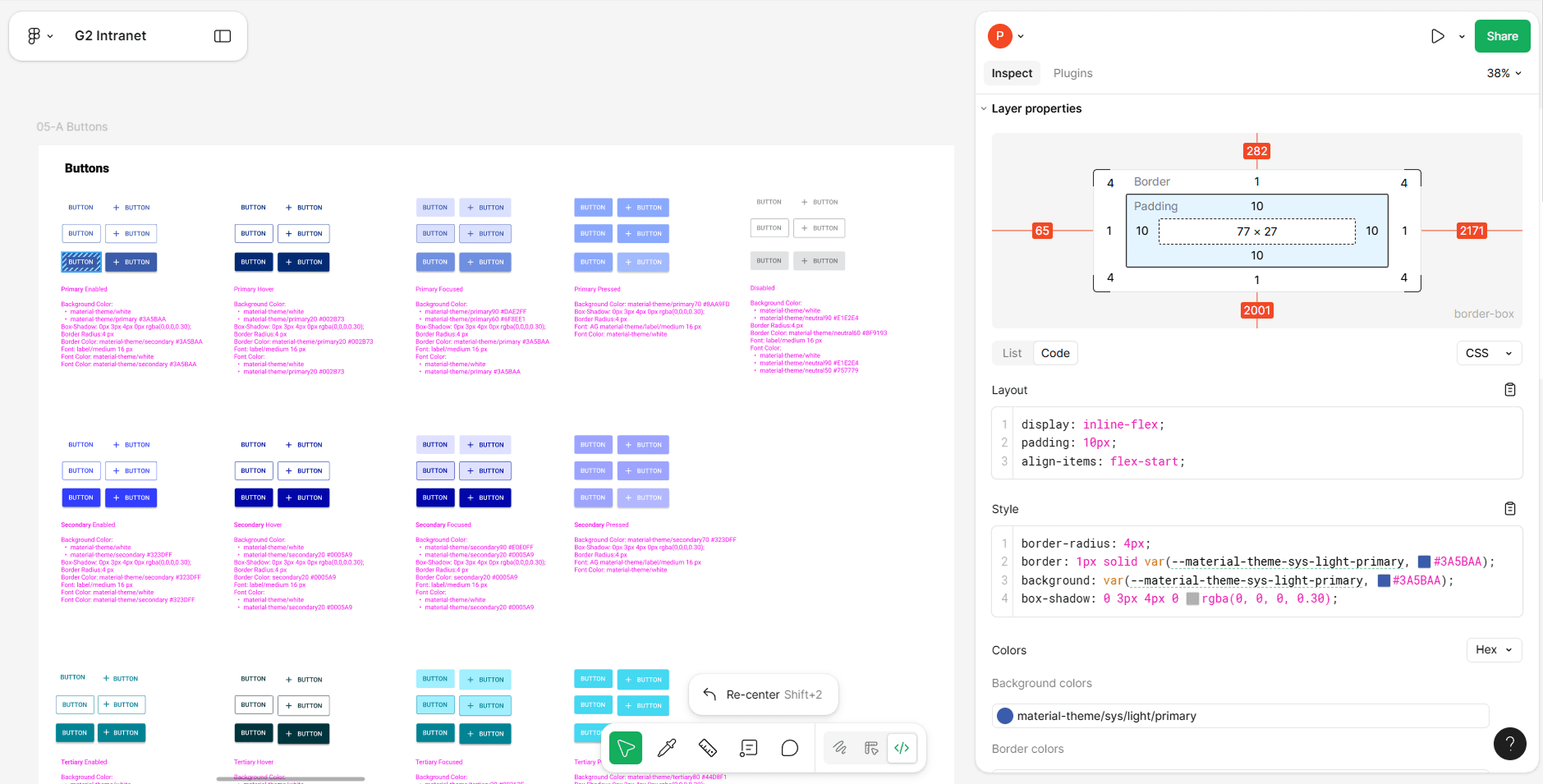

During → Clarifying Dense Underwriting Data

Low‑fidelity mockups were refined to clarify dense data views and establish consistent patterns across the underwriting workflow. The animated sequence highlighted layout improvements, hierarchy adjustments, and unified styling across Material UI.

What improved

• Clearer hierarchy for dense tables

• Predictable layouts across frameworks

• Faster scanning of risk details and exceptions

Impact (After)

Underwriters could evaluate submissions without hunting for information, and teams shared a consistent mental model for complex data.

During → Clarifying Dense Underwriting Data

Low‑fidelity mockups were refined to clarify dense data views and establish consistent patterns across the underwriting workflow. The animated sequence highlighted layout improvements, hierarchy adjustments, and unified styling across Material UI.

Low‑fidelity mockups were refined to clarify dense data views and establish consistent patterns across the underwriting workflow. The animated sequence highlighted layout improvements, hierarchy adjustments, and unified styling across Material UI.

What improved

• Clearer hierarchy for dense tables

• Predictable layouts across frameworks

• Faster scanning of risk details and exceptions

What improved

• Clearer hierarchy for dense tables

• Predictable layouts across frameworks

• Faster scanning of risk details and exceptions

Impact (After)

Underwriters could evaluate submissions without hunting for information, and teams shared a consistent mental model for complex data.

During → Real-Time Weather & Stock Widgets

We introduced lightweight React components using NOAA and financial APIs. Surfacing real‑time data was straightforward — the real value came from embedding it directly into underwriting workflows.

Introducing Lightweight React components using NOAA and financial APIs. Surfacing real‑time data was straightforward — the real value came from embedding it directly into underwriting workflows.

What was designed

Weather widgets using NOAA‑streamed conditions

Stock widgets with visual indicators for market changes

Scalable vector components styled with Google Material fonts

What was designed

Weather widgets using NOAA‑streamed conditions

Stock widgets with visual indicators for market changes

Scalable vector components styled with Google Material fonts

Impact (After)

• No more external lookups

• Faster, more confident decisions

• A governed model for future real‑time components

Impact (After)

• No more external lookups

• Faster, more confident decisions

• A governed model for future real‑time components

After → A Unified Underwriting Workspace

The redesigned underwriting dashboard consolidated fragmented tools into a single, governed workspace that improved clarity, reduced cognitive load, and accelerated underwriting decisions. While the project did not include final production screens, the design documentation itself established the patterns, components, and interaction rules that now guide implementation across the GENESIS G2 platform.

The redesigned underwriting dashboard consolidated fragmented tools into a single, governed workspace that improved clarity, reduced cognitive load, and accelerated underwriting decisions. While the project did not include final production screens, the design documentation itself established the patterns, components, and interaction rules that now guide implementation across the GENESIS G2 platform.

What the system demonstrates

• Real‑time weather and market signals surfaced directly in‑workflow

• Consistent layouts across React, Angular, and AG Grid

• Clear hierarchy for risk tiers, exceptions, and scoring

• Predictable grid behavior and scanning patterns

• Reusable Material‑aligned components for future expansion

• Tokenized theme ensuring accessibility and cross‑framework consistency

What the system demonstrates

• Real‑time weather and market signals surfaced directly in‑workflow

• Consistent layouts across React, Angular, and AG Grid

• Clear hierarchy for risk tiers, exceptions, and scoring

• Predictable grid behavior and scanning patterns

• Reusable Material‑a ligned components for future expansion

• Tokenized theme ensuring accessibility and cross‑framework consistency

Why it mattered • Underwriters made faster, more confident decisions

Engineering delivered features with less rework

Leadership gained a scalable model for future modernization

The organization aligned ar ound a single, governed design system

Why it mattered

Underwriters made faster, more confident decisions

Engineering delivered features with less rework

Leadership gained a scalable model for future modernization

The organization aligned ar ound a single, governed design system

What the system demonstrates

Real‑time weather and market signals surfaced directly in‑workflow

Consistent layouts across React, Angular, and AG Grid

Clear hierarchy for risk tiers, exceptions, and scoring

Predictable grid behavior and scanning patterns

Reusable Material‑a ligned components for future expansion

Tokenized theme ensuring accessibility and cross‑framework consistency

Why it mattered

• Underwriters made faster, more confident decisions

Engineering delivered features with less rework

Leadership gained a scalable model for future modernization

The organization aligned ar ound a single, governed design system

Impact (After)

A unified underwriting workspace that improved decision speed, reduced operational risk, and established a long‑term design foundation for General Star’s GENESIS G2 platform.

Impact (After)

A unified underwriting workspace that improved decision speed, reduced operational risk, and established a long‑term design foundation for General Star’s GENESIS G2 platform.

Other Projects

Paul Wentzell

Enterprise Product Designer

Paul Wentzell

Enterprise Product Designer

AI Assistant

Virtual Paul