Menu

> Financial Crimes Dashboard

Connect

Past Work / Financial Crimes Dashboard

Past Work / Financial Crimes Dashboard

Past Work / Financial Crimes Dashboard

Financial Crimes Investigation Dashboard

Financial Crimes Investigation Dashboard

Financial Crimes Investigation Dashboard

Unified Case Management, Faster Resolution

Unified Case Management, Faster Resolution

Read time: 10 – 15 minutes

FINRA launched “My Workspace” as part of its Digital Experience Transformation (DXT) initiative, a multi‑year effort to shorten the time between incident reporting and resolution. The platform consolidated fragmented investigative tools into a single workspace, integrating case status, shared account views, and investigator‑specific logic. By eliminating manual reconciliation and duplication, My Workspace provided teams with a transparent, centralized view of progress — accelerating decisions and reinforcing FINRA’s system‑level governance.

FINRA launched “My Workspace” as part of its Digital Experience Transformation (DXT) initiative, a multi‑year effort to shorten the time between incident reporting and resolution. The platform consolidated fragmented investigative tools into a single workspace, integrating case status, shared account views, and investigator‑specific logic. By eliminating manual reconciliation and duplication, My Workspace provided teams with a transparent, centralized view of progress — accelerating decisions and reinforcing FINRA’s system‑level governance.

Client / FINRA

Client / The Financial Industry Regulatory Authority (FINRA)

Category / Finance

Category / Finance

Category / Finance

Team / UX, Product, Engineering

Team / UX, Product, Engineering

Team / UX, Product, Engineering

Platform / Desktop

Platform / Desktop

Platform / Desktop

Understanding the problem

FINRA’s investigative tools were fragmented across platforms, forcing teams to manually reconcile case status, shared accounts, and investigator notes. This slowed decisions and created duplication. At the org level, leadership prioritized reducing the time between incident reporting and resolution — but the existing tools made that goal unreachable.

Manual Reconciliation: Case data had to be stitched together across interfaces and databases

Limited Visibility: No centralized view of investigations across teams or roles

Duplicate Efforts: Missed collaboration opportunities and redundant workstreams

Dense Data Tables: Poorly configured layouts slowed comprehension and decision-making

Inconsistent Navigation: UI logic varied across tools, increasing cognitive load

No Design System: Lack of reusable patterns or intuitive workflows

Cumbersome Workflows: Time usage tied to inefficient task flows and unclear prioritization

Discovery: Understanding the Problem

Fragmented Tools, Limited Transparency

FINRA’s investigative teams operated within a maze of outdated, siloed systems that slowed resolution times and obscured case visibility. Investigators had to manually reconcile data across disconnected interfaces, with no unified view of progress or shared coordination across teams

The lack of intuitive design patterns, centralized workflows, and role-based visibility made it difficult to prioritize resources, align strategies, or respond swiftly to emerging threats.

Manual Reconciliation: Case data had to be stitched together across interfaces and databases

Limited Visibility: No centralized view of investigations across teams or roles

Duplicate Efforts: Missed collaboration opportunities and redundant workstreams

Dense Data Tables: Poorly configured layouts slowed comprehension and decision-making

Inconsistent Navigation: UI logic varied across tools, increasing cognitive load

No Design System: Lack of reusable patterns or intuitive workflows

Cumbersome Workflows: Time usage tied to inefficient task flows and unclear prioritization

Discovery: Understanding the Problem

Fragmented Tools, Limited Transparency

FINRA’s investigative teams operated within a maze of outdated, siloed systems that slowed resolution times and obscured case visibility. Investigators had to manually reconcile data across disconnected interfaces, with no unified view of progress or shared coordination across teams

The lack of intuitive design patterns, centralized workflows, and role-based visibility made it difficult to prioritize resources, align strategies, or respond swiftly to emerging threats.

Manual Reconciliation: Case data had to be stitched together across interfaces and databases

Limited Visibility: No centralized view of investigations across teams or roles

Duplicate Efforts: Missed collaboration opportunities and redundant workstreams

Dense Data Tables: Poorly configured layouts slowed comprehension and decision-making

Inconsistent Navigation: UI logic varied across tools, increasing cognitive load

No Design System: Lack of reusable patterns or intuitive workflows

Cumbersome Workflows: Time usage tied to inefficient task flows and unclear prioritization

Contextual Inquiry

Challenge Addressed:

FINRA’s investigative workflows were fragmented and difficult to trace across systems. Existing tools lacked usability benchmarks tailored to investigator roles, and design decisions weren’t grounded in real user behavior.

Challenge Addressed:

FINRA’s investigative workflows were fragmented and difficult to trace across systems. Existing tools lacked usability benchmarks tailored to investigator roles, and design decisions weren’t grounded in real user behavior.

Response:

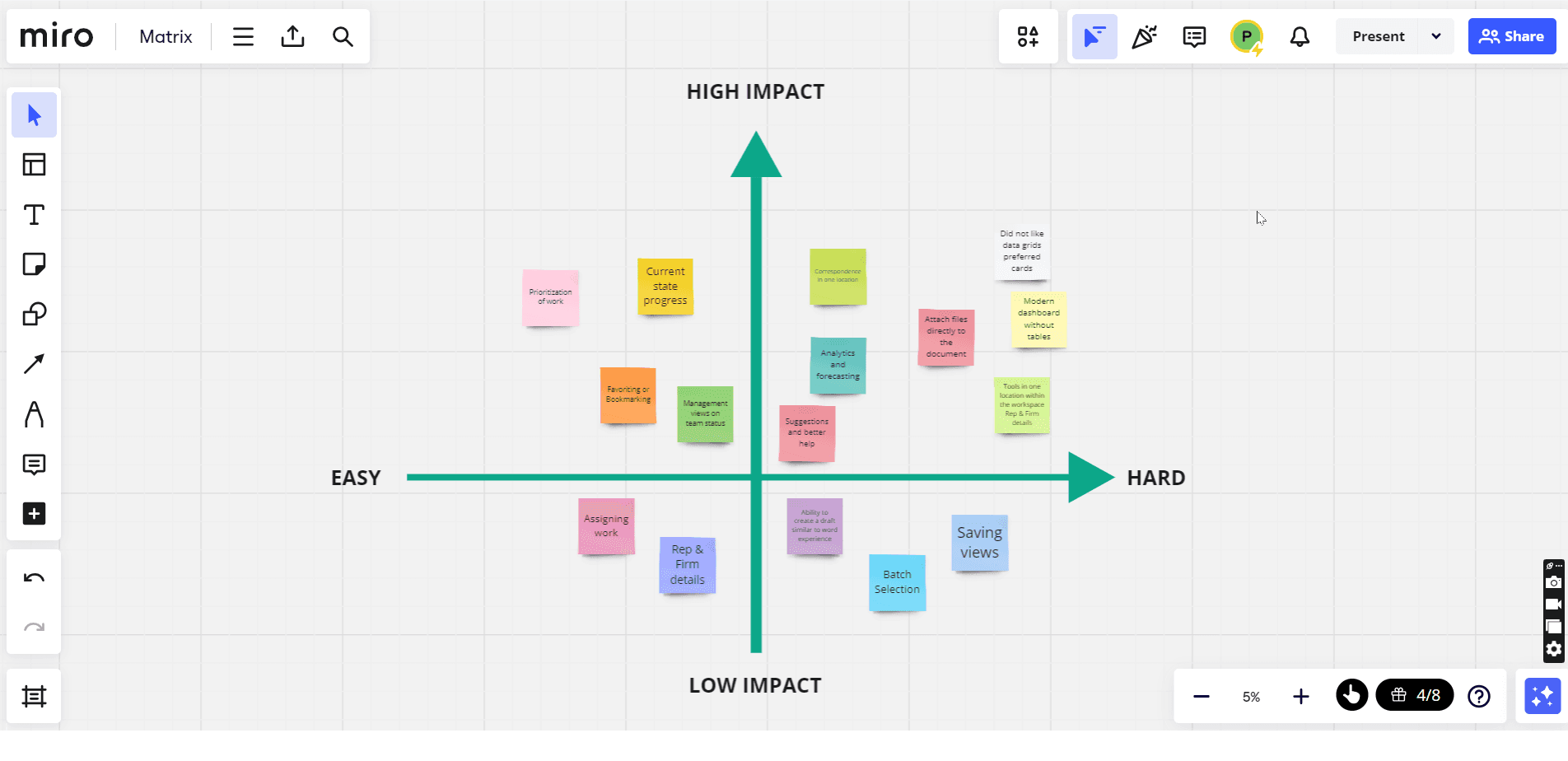

Task Analysis: Mapped investigative processes into actionable steps—surfacing dependencies, friction points, and opportunities for optimization.

Contextual Inquiry: Observed investigators in their natural work environments and conducted interviews to uncover workflow patterns, behavioral pain points, and cognitive preferences.

Feature Prioritization: Synthesized cross-team feedback into a ranked feature set, guiding the foundation of “My Workspace”.

Response:

Task Analysis: Mapped investigative processes into actionable steps—surfacing dependencies, friction points, and opportunities for optimization.

Contextual Inquiry: Observed investigators in their natural work environments and conducted interviews to uncover workflow patterns, behavioral pain points, and cognitive preferences.

Feature Prioritization: Synthesized cross-team feedback into a ranked feature set, guiding the foundation of “My Workspace”.

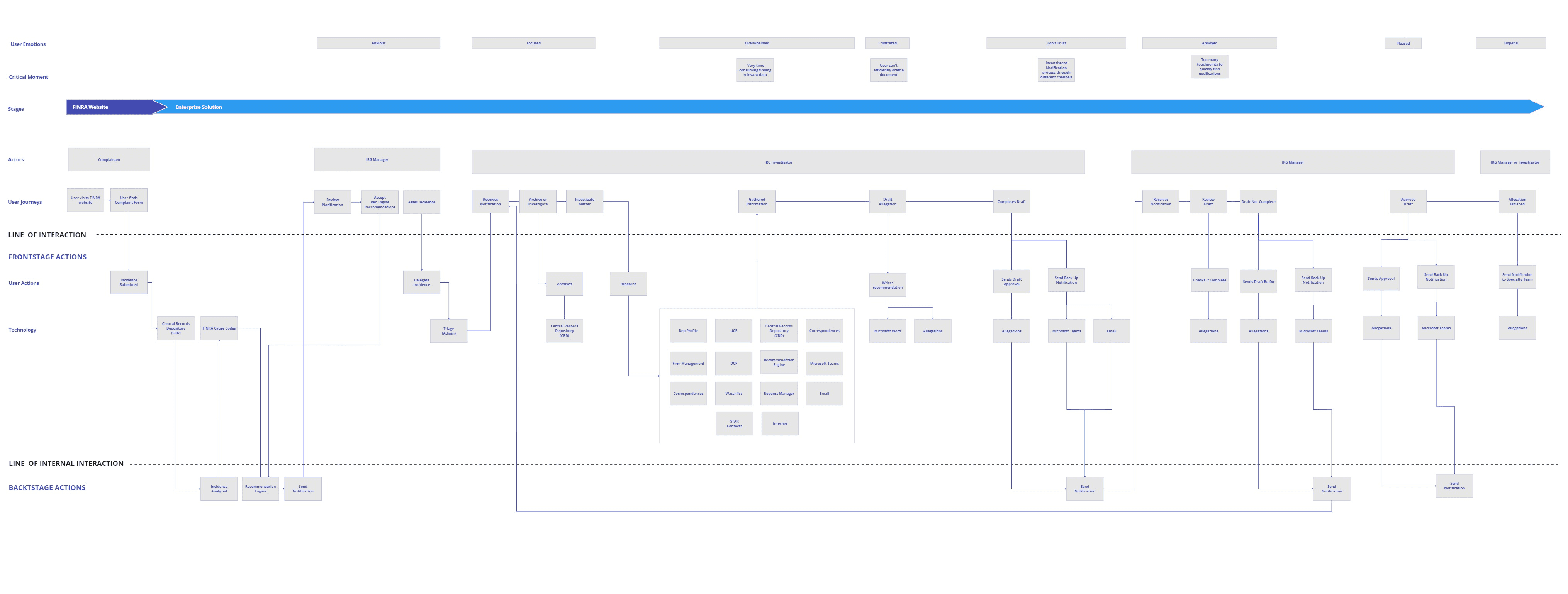

Workflow Architecture

Challenge Addressed:

Investigative workflows were complex and varied across roles, making it difficult to design a scalable, intuitive solution. Existing tools lacked usability benchmarks tailored to FINRA’s investigative context, and early design decisions were based on assumptions rather than user mental models.

Challenge Addressed:

Investigative workflows were complex and varied across roles, making it difficult to design a scalable, intuitive solution. Existing tools lacked usability benchmarks tailored to FINRA’s investigative context, and early design decisions were based on assumptions rather than user mental models.

Response:

Visualized system interactions and role-specific behaviors to inform layout structure and navigation hierarchy.

Mapped investigative workflows into decision trees and parallel paths to clarify task dependencies and escalation logic.

Response:

Visualized system interactions and role-specific behaviors to inform layout structure and navigation hierarchy.

Mapped investigative workflows into decision trees and parallel paths to clarify task dependencies and escalation logic.

Response:

Visualized system interactions and role-specific behaviors to inform layout structure and navigation hierarchy.

Mapped investigative workflows into decision trees and parallel paths to clarify task dependencies and escalation logic.

Investigative Workflow Mapping

Challenge Addressed:

Investigative workflows lacked visibility across roles, tools, and handoffs. Coordination was inefficient, and dependencies were buried within siloed processes—making it difficult to align teams or streamline delivery.

Challenge Addressed:

Cross-functional alignment was essential to shaping “My Workspace.” Design, product, and engineering teams needed a shared space for ideation, documentation, and feedback. Communication had to be structured, traceable, and accessible across phases.

Response:

Defined roles and responsibilities to clarify ownership, reduce ambiguity, and improve cross-functional coordination.

Mapped investigator touchpoints across the service journey to identify unmet needs, inefficiencies, and critical moments of interaction.

Visualized end-to-end processes to surface dependencies, handoffs, and inefficiencies enabling a more seamless and scalable investigative experience.

Response:

Leveraged Miro templates and mind mapping tools to visualize workflows, prioritize features, and structure team input.

Facilitated real-time feedback via Miro’s commenting and tagging, ensuring traceable design decisions and continuous stakeholder alignment

Response:

Defined roles and responsibilities to clarify ownership, reduce ambiguity, and improve cross-functional coordination.

Mapped investigator touchpoints across the service journey to identify unmet needs, inefficiencies, and critical moments of interaction.

Visualized end-to-end processes to surface dependencies, handoffs, and inefficiencies enabling a more seamless and scalable investigative experience.

Structured Collaboration

Challenge Addressed:

Cross-functional alignment was essential to shaping “My Workspace.” Design, product, and engineering teams needed a shared space for ideation, documentation, and feedback. Communication had to be structured, traceable, and accessible across phases.

Challenge Addressed:

Investigative workflows lacked visibility across roles, tools, and handoffs. Coordination was inefficient, and dependencies were buried within siloed processes—making it difficult to align teams or streamline delivery.

Response:

Leveraged Miro templates and mind mapping tools to visualize workflows, prioritize features, and structure team input.

Facilitated real-time feedback via Miro’s commenting and tagging, ensuring traceable design decisions and continuous stakeholder alignment

Response:

Defined roles and responsibilities to clarify ownership, reduce ambiguity, and improve cross-functional coordination.

Mapped investigator touchpoints across the service journey to identify unmet needs, inefficiencies, and critical moments of interaction.

Visualized end-to-end processes to surface dependencies, handoffs, and inefficiencies enabling a more seamless and scalable investigative experience.

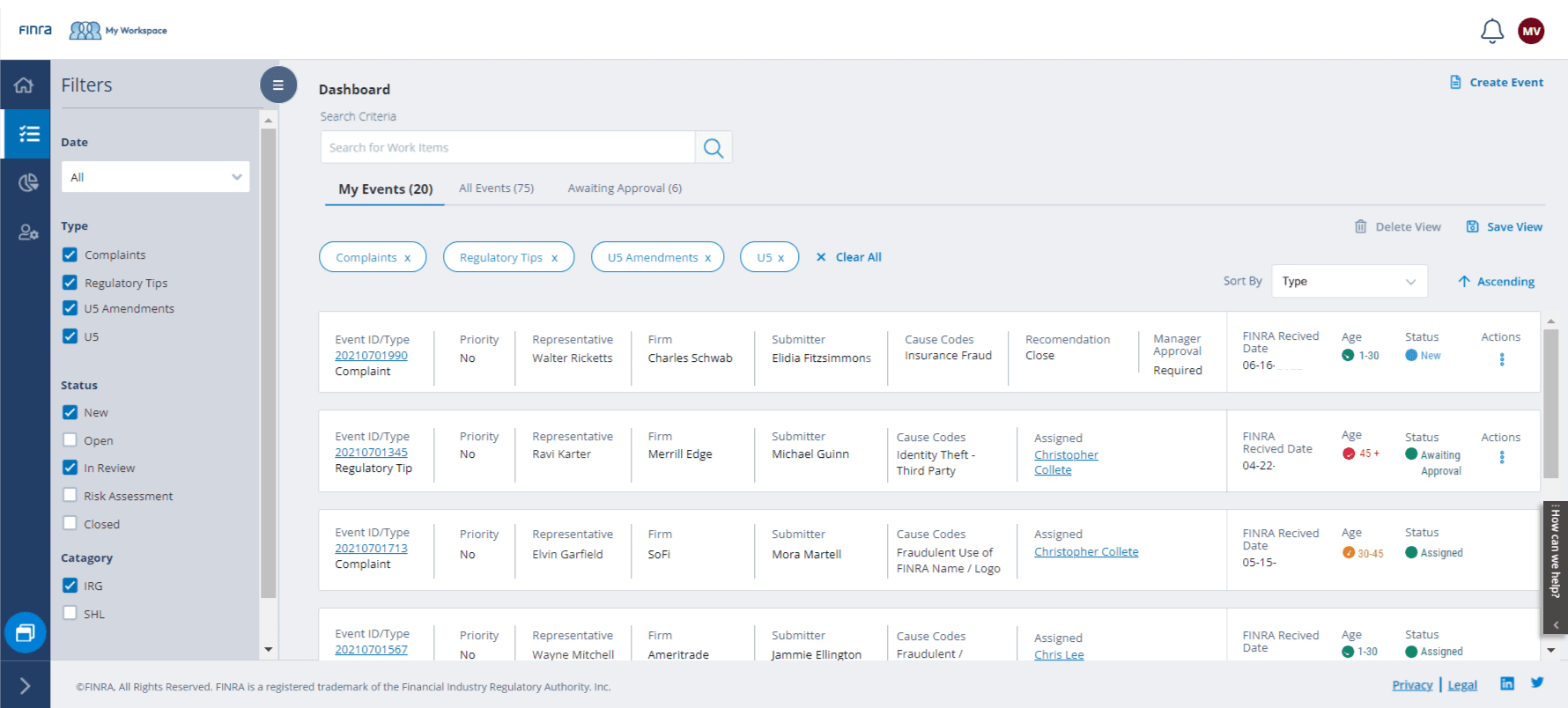

Interaction Fidelity

Challenge Addressed:

Investigative workflows required realistic data table behavior—including horizontal scrolling and multi-tab navigation—to validate usability. Early design concepts needed stakeholder feedback before committing to full implementation, and prototypes had to reflect operational complexity while remaining flexible for iteration.

Challenge Addressed:

Investigative workflows required realistic data table behavior—including horizontal scrolling and multi-tab navigation—to validate usability. Early design concepts needed stakeholder feedback before committing to full implementation, and prototypes had to reflect operational complexity while remaining flexible for iteration.

Response:

Built wireframes to explore layout and structure, enabling rapid feedback cycles and early refinement.

Used Axure RP to simulate complex data tables and scrolling behavior for realistic interaction modeling.

Developed low-fidelity prototypes for usability testing, incorporating stakeholder input to align design with investigative workflows and operational needs.

Response:

Built wireframes to explore layout and structure, enabling rapid feedback cycles and early refinement.

Used Axure RP to simulate complex data tables and scrolling behavior for realistic interaction modeling.

Developed low-fidelity prototypes for usability testing, incorporating stakeholder input to align design with investigative workflows and operational needs.

Response:

Built wireframes to explore layout and structure, enabling rapid feedback cycles and early refinement.

Used Axure RP to simulate complex data tables and scrolling behavior for realistic interaction modeling.

Developed low-fidelity prototypes for usability testing, incorporating stakeholder input to align design with investigative workflows and operational needs.

Design: Fast Validation

Aligning design with user roles through real-time feedback

Challenge Addressed:

Design decisions needed to be validated quickly and continuously with real users.

Response:

Conducted iterative feedback cycles to identify pain points and refine layouts, workflows, and component behavior.

Shared interactive prototypes via Axshare to collect real-time comments, usability insights, and design suggestions directly on the interface.

Facilitated collaborative reviews in context of the user roles, ensuring alignment between stakeholder goals and investigator needs.

Fast Validation

Challenge Addressed:

Design decisions needed to be validated quickly and continuously with real users.

Response:

Conducted iterative feedback cycles to identify pain points and refine layouts, workflows, and component behavior.

Shared interactive prototypes via Axshare to collect real-time comments, usability insights, and design suggestions directly on the interface.

Facilitated collaborative reviews in context of the user roles, ensuring alignment between stakeholder goals and investigator needs.

Visual Clarity

Challenge Addressed:

Interfaces needed to support diverse investigative roles and cognitive styles while meeting accessibility standards and reinforcing FINRA’s brand identity. Visual clarity was essential to streamline workflows and build user trust.

Challenge Addressed:

Interfaces needed to support diverse investigative roles and cognitive styles while meeting accessibility standards and reinforcing FINRA’s brand identity. Visual clarity was essential to streamline workflows and build user trust.

Response:

Incorporated WCAG accessibility standards to ensure usability for individuals with disabilities and compliance with regulatory expectations.

Applied user-friendly design principles with intuitive navigation and clear visual hierarchy to guide investigators through complex workflow.

Aligned with FINRA branding by integrating approved color schemes, typography, and iconography—reinforcing consistency and credibility across the platform.

Response:

Incorporated WCAG accessibility standards to ensure usability for individuals with disabilities and compliance with regulatory expectations.

Applied user-friendly design principles with intuitive navigation and clear visual hierarchy to guide investigators through complex workflow.

Aligned with FINRA branding by integrating approved color schemes, typography, and iconography—reinforcing consistency and credibility across the platform.

Centralizing Complexity into a Streamlined Investigator Experience

“My Workspace” transformed FINRA’s fragmented toolset into a centralized, investigator-centered dashboard—streamlining workflows, improving transparency, and accelerating time-to-resolution across teams.

“My Workspace” transformed FINRA’s fragmented toolset into a centralized, investigator-centered dashboard—streamlining workflows, improving transparency, and accelerating time-to-resolution across teams.

Outcomes

Investigator-Centered Experience

Delivered a unified dashboard that simplified workflows, reduced tool-switching, and clarified case data—empowering teams to focus on analysis, not navigationDesign System Integration

Aligned with FINRA’s DXT design system and integrated seamlessly into My Gateway, supporting future enhancements and cross-team adoptionBrand & Accessibility Alignment

Applied FINRA’s branding guidelines and WCAG standards to ensure visual consistency and inclusive usabilityOperational Impact

Accelerated time-to-resolution, improved cross-team transparency, and reduced duplication—establishing “My Workspace” as a strategic hub for investigative coordination

Outcomes

Investigator-Centered Experience

Delivered a unified dashboard that simplified workflows, reduced tool-switching, and clarified case data—empowering teams to focus on analysis, not navigationDesign System Integration

Aligned with FINRA’s DXT design system and integrated seamlessly into My Gateway, supporting future enhancements and cross-team adoptionBrand & Accessibility Alignment

Applied FINRA’s branding guidelines and WCAG standards to ensure visual consistency and inclusive usabilityOperational Impact

Accelerated time-to-resolution, improved cross-team transparency, and reduced duplication—establishing “My Workspace” as a strategic hub for investigative coordination

Other Projects

Paul Wentzell

Enterprise Product Designer

Paul Wentzell

Enterprise Product Designer

AI Assistant

Virtual Paul